Eventos na próxima semana | 19/05/2017

May 22nd – 26th | BoC policy meeting, OPEC & non-OPEC gathering, FOMC minutes, key data in focus

• The Bank of Canada is expected to stand pat once again. We see the case for policymakers to shift to an even more cautious tone than previously, in light of the recent tariffs from the US.

• In Vienna, major OPEC and non-OPEC producers will meet. The latest comments suggest that November’s oil output-cut deal is very likely to be extended by 9 months.

• In the US, the minutes from the latest FOMC meeting could shed some light on whether the Committee is indeed set to hike in June should economic data hold up.

• We also get key economic data from Germany, Eurozone, the UK, the US, and Japan.

On Monday, we have a quiet calendar day, with no major events or indicators due to be released.

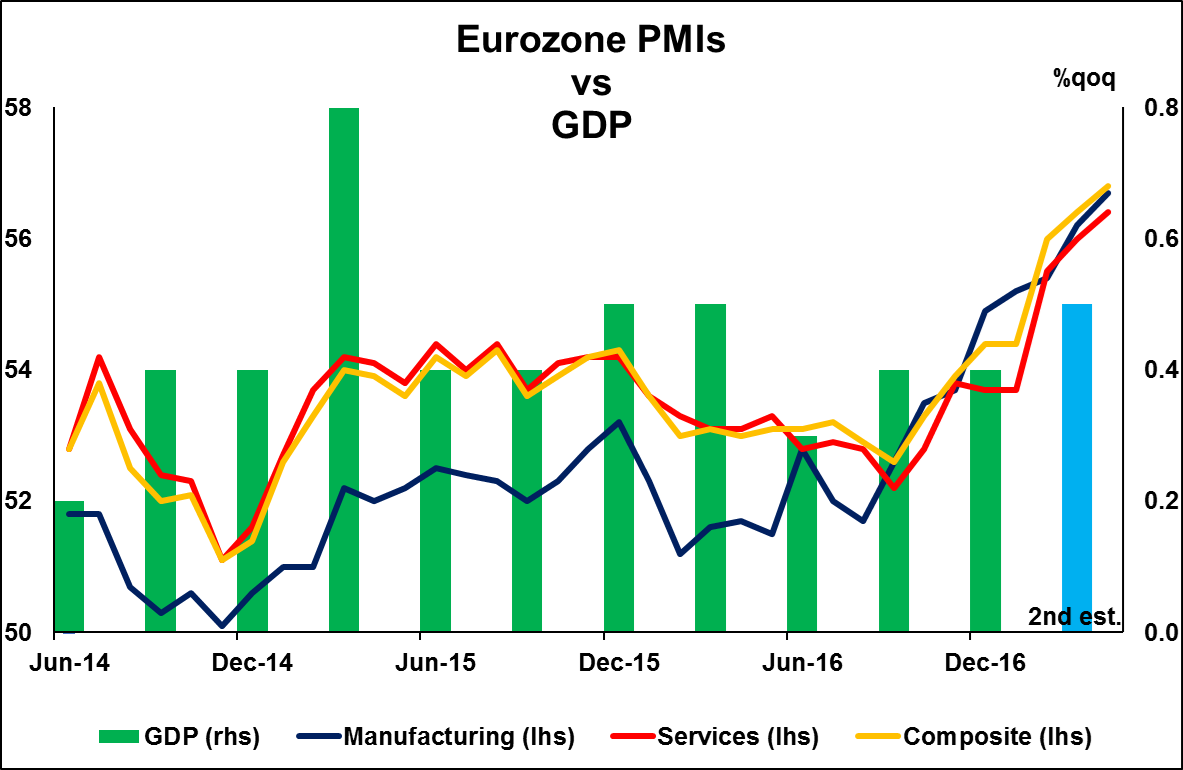

On Tuesday, Eurozone’s preliminary manufacturing and services PMIs for May will be in focus, though no forecast is available for any index yet. April’s composite survey was particularly upbeat, indicating that the bloc’s economy is growing at an encouragingly robust pace. What’s more, the report shows that price pressures remain elevated with the price index suggesting that core inflation will trend higher in coming months. Should May’s survey indicate similar results, we think that this could enhance even further speculation regarding an increasingly more optimistic ECB at its upcoming meetings, especially since the bloc’s latest “hard data” are already consistent with such a move by the Bank.

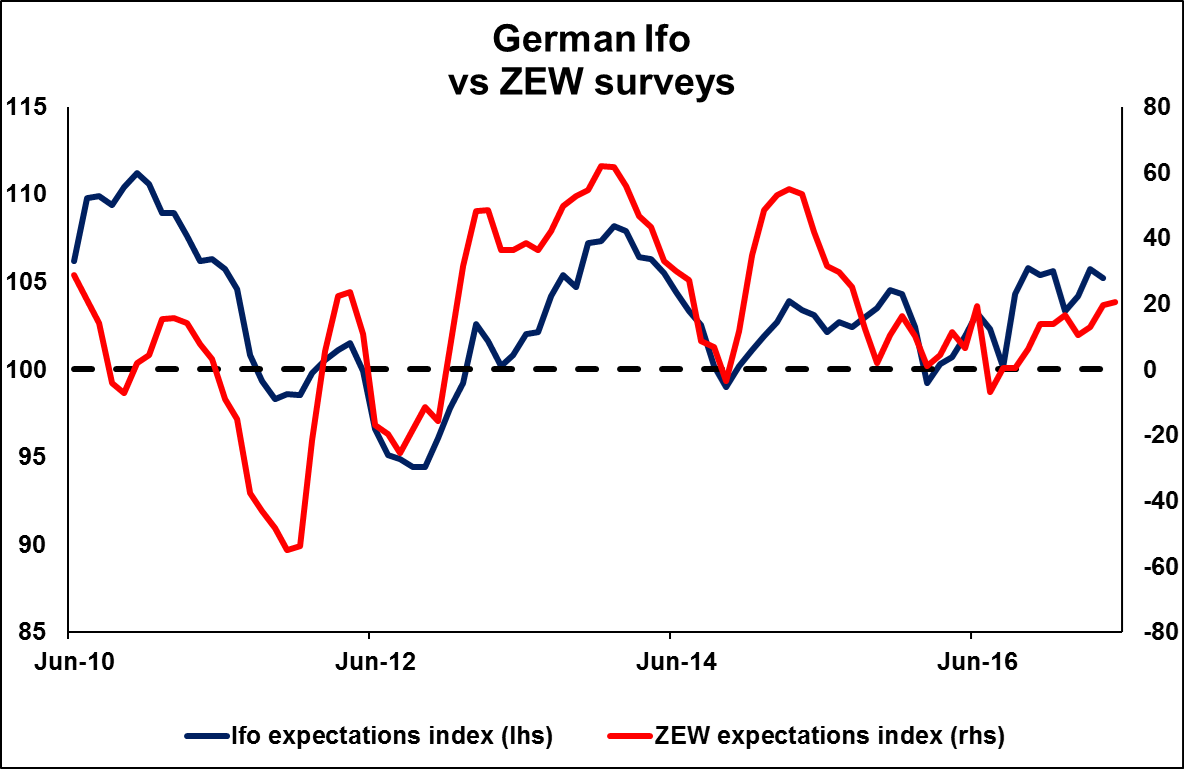

From Germany, we get the Ifo survey for May. Without a forecast available, we see the case for both the current conditions and the expectations indices to have risen. We base our view on the ZEW survey for the month, which indicated that both the expectations and the current conditions assessments of financial analysts rose during the month. The survey showed that the prospects for the Eurozone as a whole are improving, a factor that strengthens the economic environment for German exports. We expect the Ifo survey to indicate a similarly upbeat message coming from German businesses, especially considering that Eurozone’s political risks are now out of the way.

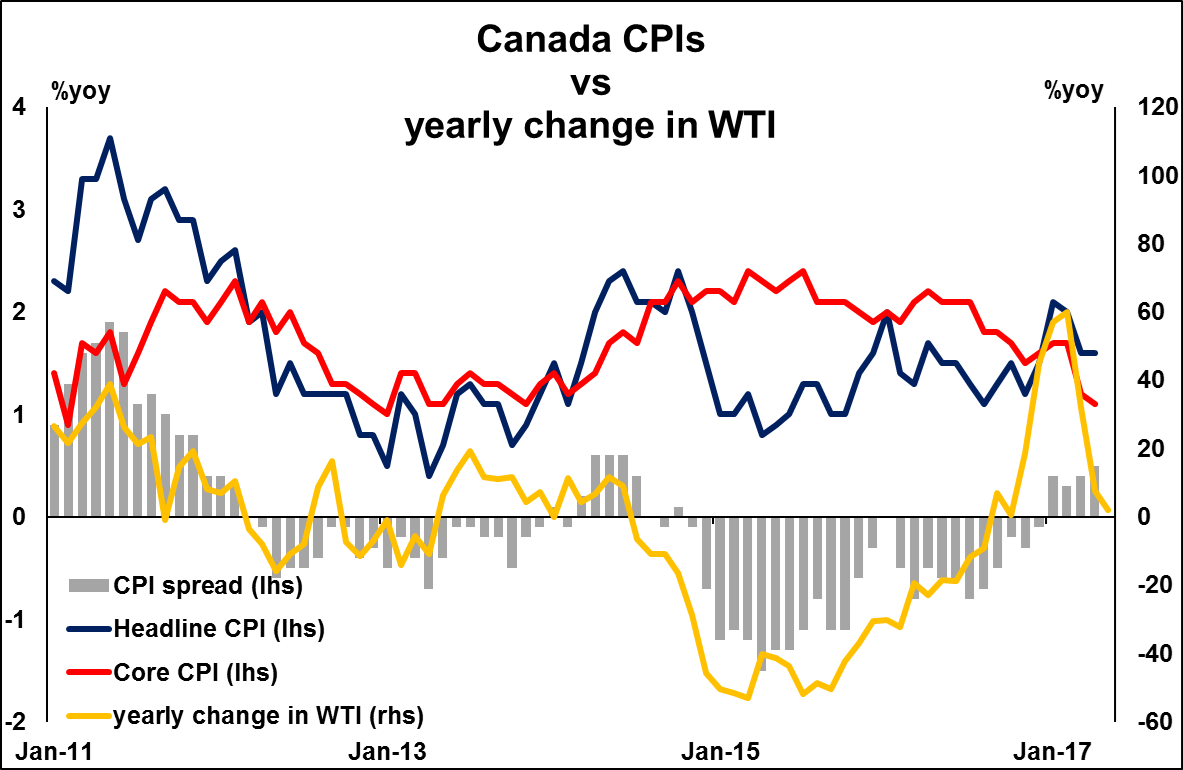

On Wednesday, all eyes will be on the Bank of Canada rate decision. The forecast is for the Bank to remain on hold once again. Policymakers maintained a neutral tone the last time they met, balancing every upbeat comment about the economy with a worried follow-up remark. The key message we got was that Canadian economic data are improving, but the Bank thinks it is too soon to materially alter its stance, mainly due to uncertainties related to the outlook for trade. Indeed, BoC policymakers now probably feel vindicated about their cautious stance, considering that shortly after that policy meeting, the US imposed tariffs on Canada. Given also that recent economic data have been soft, with the core CPI falling further in April and February’s GDP stagnating, we consider it likely that the BoC will maintain, if not amplify further, its concerned message.

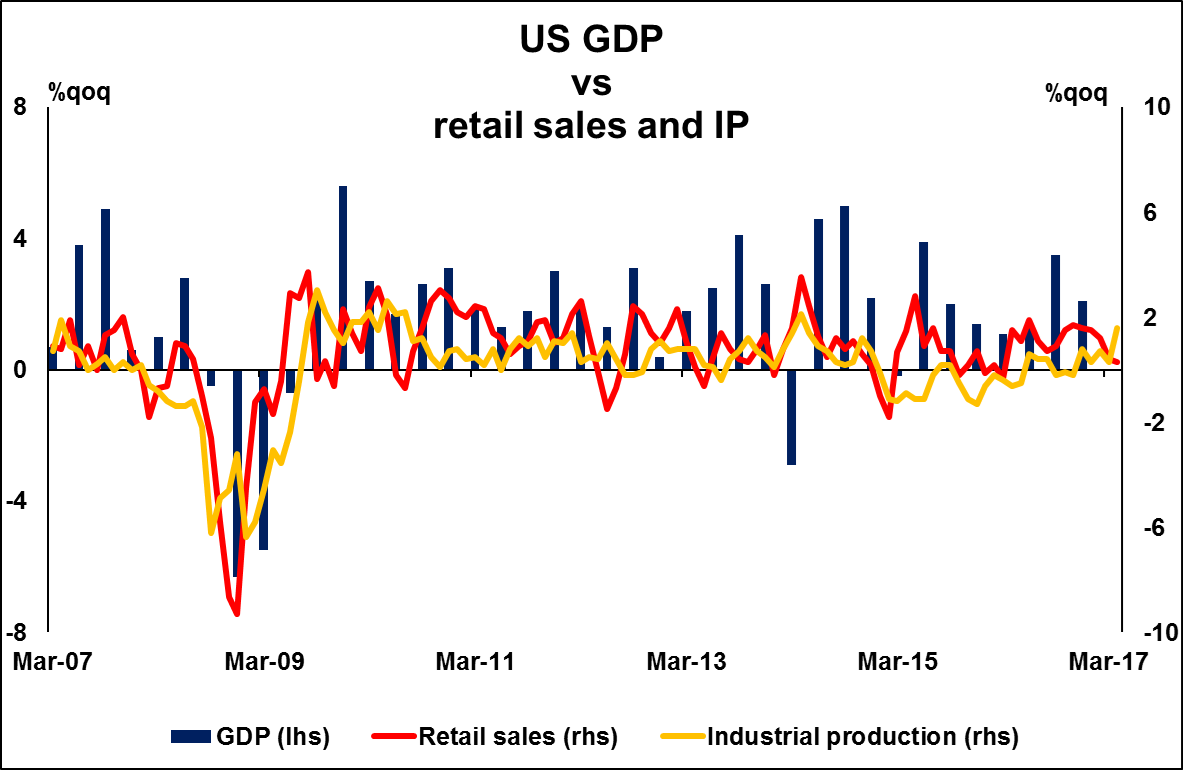

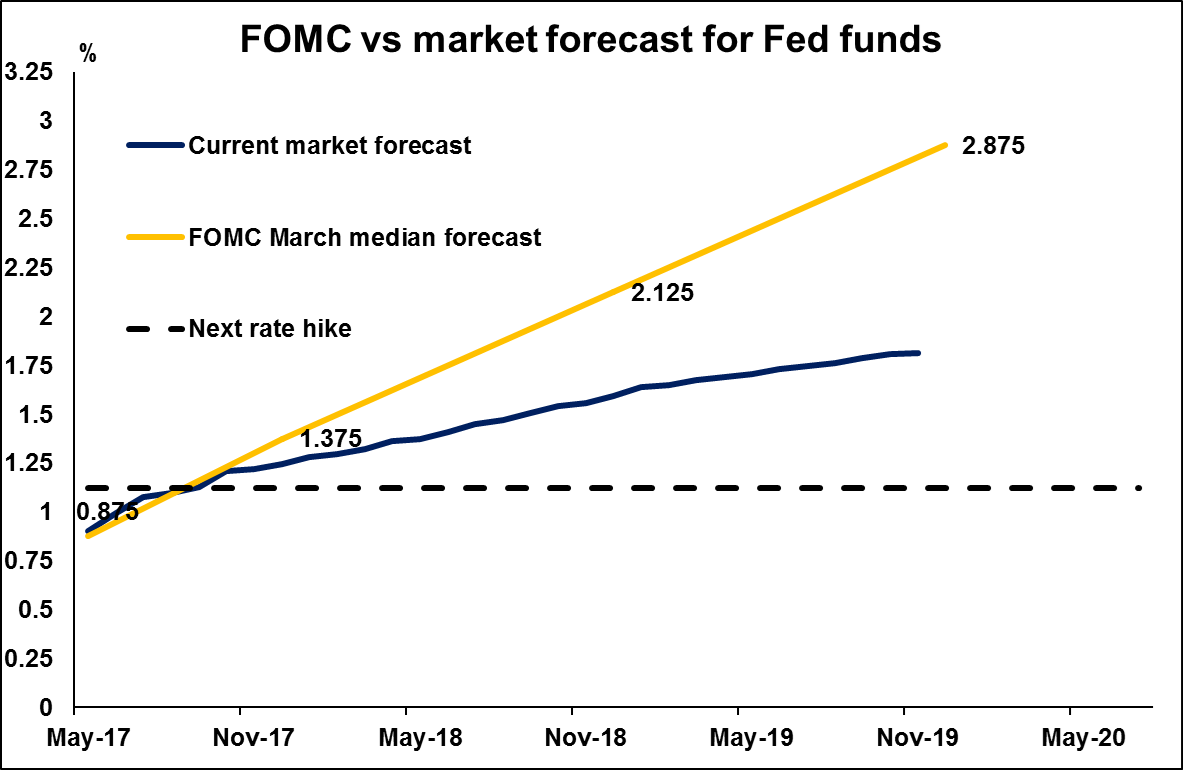

In the US, the main event will be the release of the minutes from the FOMC’s May policy gathering, where the Committee kept its policy unchanged and offered very few hints with regards to the timing of the next rate hike. The most noteworthy point in the statement was that policymakers view the slowdown in Q1 GDP as transitory, implying this softness will not deter them from hiking rates again in the near-term should growth rebound in Q2. Indeed the Atlanta Fed GDPNow model adds credibility to that scenario by indicating that GDP growth rebounded to 4.1% in Q2. Besides that point, the statement was more or less a reiteration of the previous one and as such, we expect investors to scan the minutes for any clear clues as to whether the next hike is likely to come as early as June. At the time of writing, the probability for such action rests at roughly 78% and if the minutes confirm the Bank is likely to act soon in case economic data evolve as it expects, we think that probability is likely to rise further.

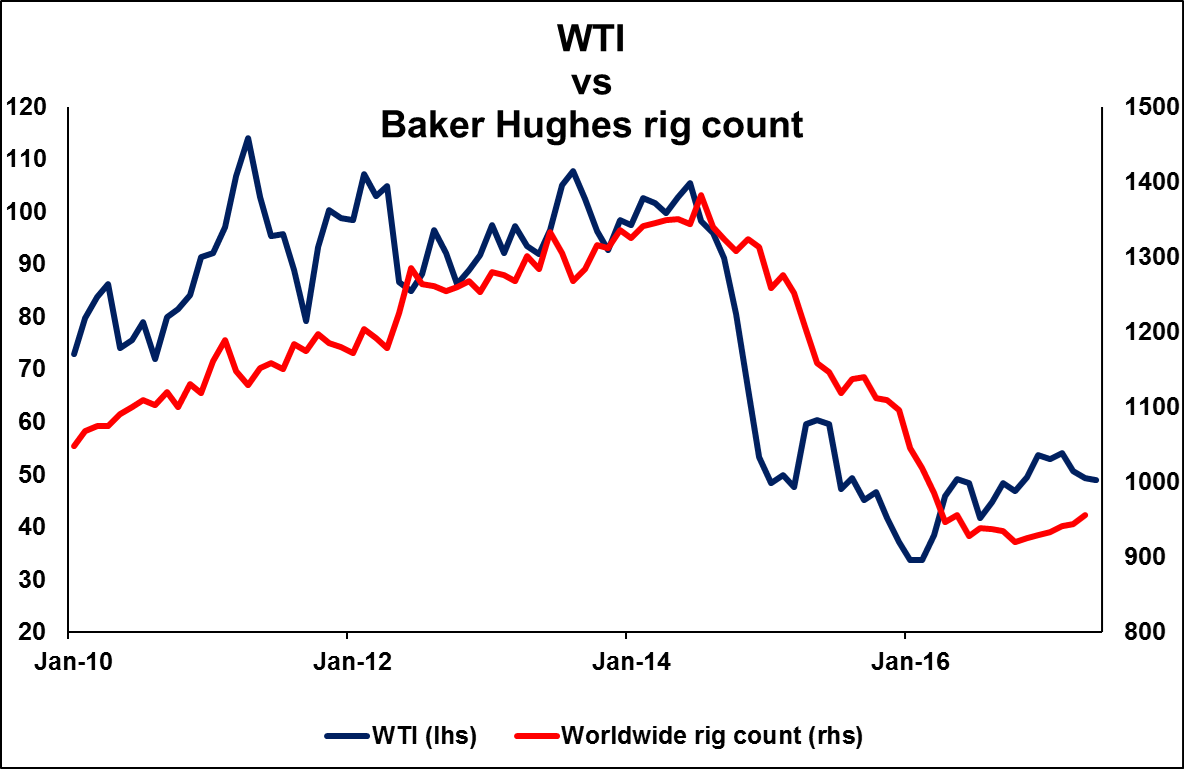

On Thursday, the highly anticipated meeting between major OPEC and non-OPEC oil producers will take place in Vienna. The latest comments from the oil ministers of Saudi Arabia and Russia, the largest OPEC and non-OPEC producers respectively, suggest that they have agreed to extend the November oil-output cut deal until March 2018, an extension of 9 months at the current volume of 1.8 mbpd. Heading into the meeting, we think that more optimistic comments regarding the prospect of such an extension could keep oil prices supported. Chatter for deeper production cuts could lift prices further. However, if all we finally get is a 9-month extension, we see further upside in oil prices as likely being limited. In our view, most, if not all, the good news are probably already priced in following the comments from the Saudi and Russian ministers. As such, in order for oil prices to rally significantly, we believe that producers have to deliver something over and above what the market currently expects, namely an extension of a full year and/or deeper production cuts. As for the bigger picture, we stick to our long-term view that even in case of the anticipated accord, a long-term healthy uptrend in oil prices is still unlikely. The continued increase in US production – evident by the latest EIA data as well as the recovery in the Baker Hughes oil rig count – is likely to keep a lid on any significant gains in the precious liquid’s price. In addition, there is also the risk that the nations which are exempted from the production cuts, Libya and Nigeria, raise their output notably, thereby offsetting some of the cuts from the other producers.

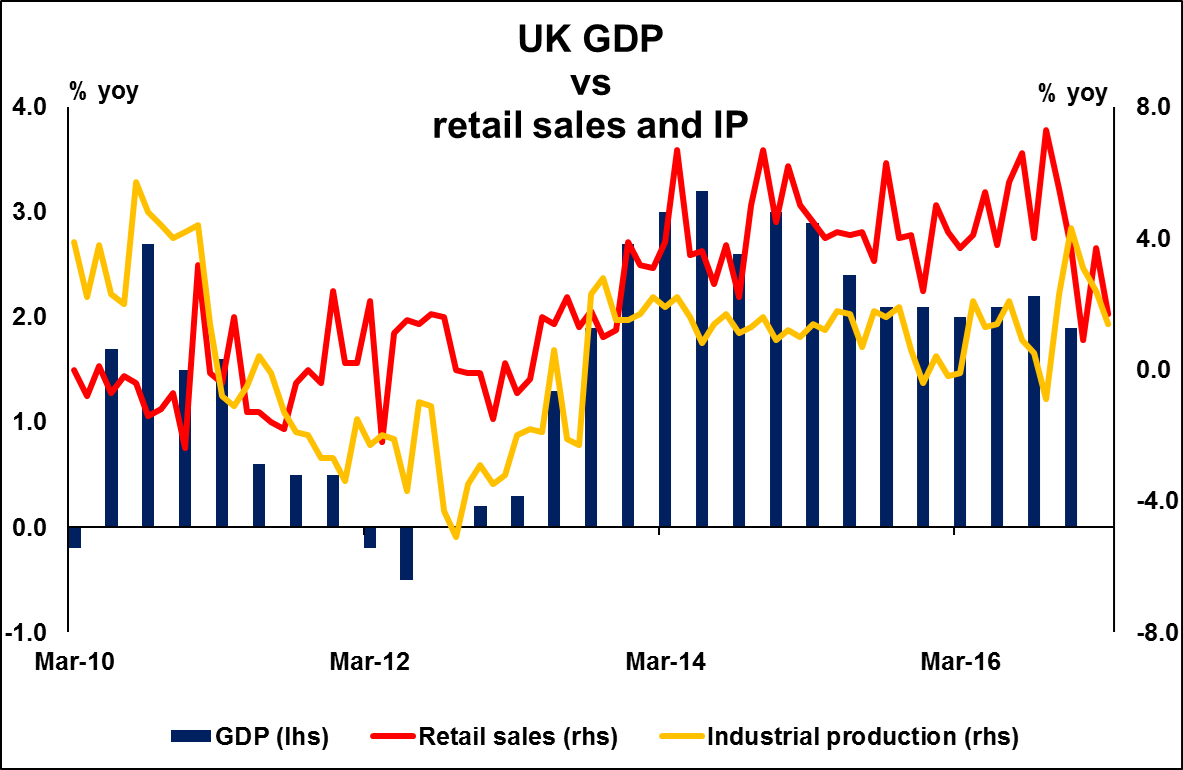

With regards to the economic data, from the UK we get the 2nd estimate of GDP for Q1. Without a forecast available, we see the case for the 2nd reading to be in line with the preliminary figure and confirm that economic growth slowed notably from Q4. This data release will also include business investment data for Q1, which we expect to attract a lot of attention considering that investment surprisingly declined the previous quarter. This generated concerns that the first real impact of Brexit-related uncertainties had shown up, as firms appeared hesitant to invest in the UK ahead of the impending Brexit negotiations. As a result, we expect investors to pay close attention to the Q1 print, in order to determine whether this was a one-off, or if Brexit jitters have already began to weigh on economic growth.

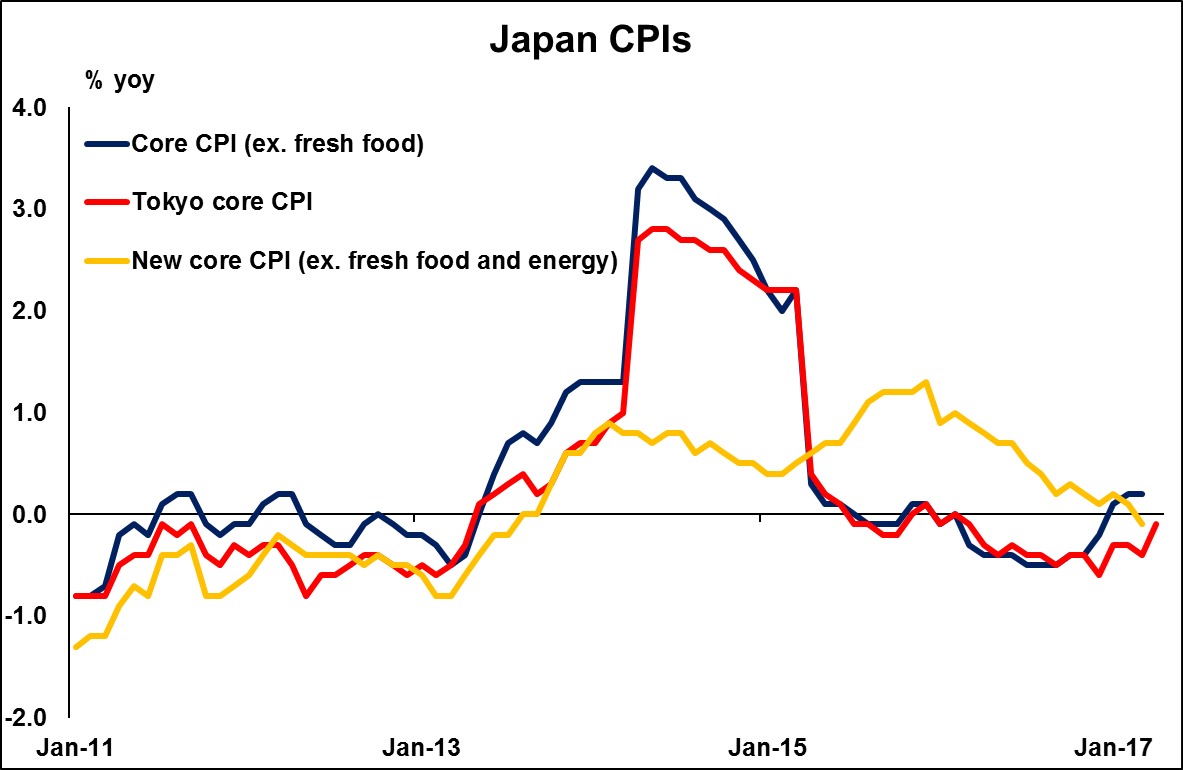

On Friday, during the Asian morning, Japan will release its CPI data for April, though no forecast is available for any figure yet. Our own view is that both the headline and core rates likely rose during the month, which we base on the nation’s Tokyo CPI prints for the same month. Both the headline and the core Tokyo rates rose by more than anticipated. Even though something like that would probably be encouraging news for BoJ policymakers, as long as both the nationwide rates remain stuck close to 0%, we do not expect the Bank to alter its current policy framework.

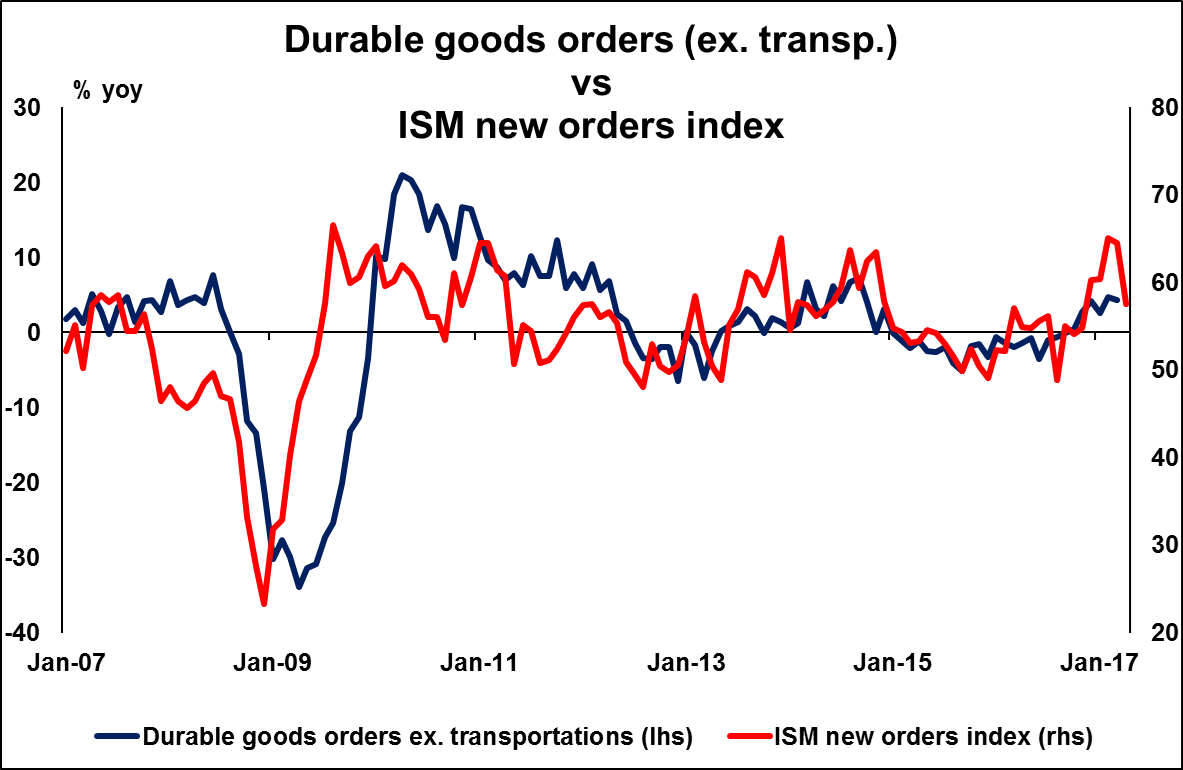

In the US, durable goods orders for April are due to be released. The forecast is for the headline rate to have fallen, while the core rate that excludes transportation equipment, is expected to have risen following a stagnant print in March. We share the view for a decline in the headline print, considering the slowdown in civilian aircraft orders in April, while we see the risks surrounding the core forecast as skewed to the downside. We base our view for the core print on the nation’s ISM manufacturing PMI, which showed that new orders slowed down notably during the month.

As for the rest of the US data, we also get the 2nd estimate of Q1 GDP. Expectations are for economic growth to have been revised upwards, albeit slightly. However, we doubt that it will have much market impact, given that the Fed has already pointed that the growth softness throughout the quarter was transitory. As a result, we think that investors will pay more attention to incoming US data for Q2, as well as the Atlanta Fed GDPNow model, in order to get a better picture of whether economic activity have rebounded. Any signs of such a rebound may strengthen the case for a June hike further.