Eventos na próxima semana | 09/05/2017

May 8th – 12th | Second round of French elections, BoE & RBNZ meetings, key data in focus

• In France, voters will head to the polls once again. Macron is widely anticipated to win and as such, we think that the risks surrounding the euro’s reaction from this event are asymmetrical.

• The Bank of England is likely to stand pat. We see the case for officials to shift to a somewhat more concerned tone than previously following the latest slowdown in economic growth.

• In New Zealand, we expect the RBNZ to stay on hold as well, and could even keep the door for further easing open, despite the latest improvement in economic data.

• We also get key economic data from the US and China.

Important events begin early next week. On Sunday, French citizens will head to the polls for the second and final round of their Presidential election. The two candidates are Emmanuel Macron and Marine Le Pen. Given the massive market reaction after the first round, when both the euro and European stock indices surged, we think that much of the “Frexit” risk has been already priced out of European assets. This is evident by the narrowing spread between the yields of French and German 10-year bonds. As such, we view the risks surrounding the euro’s reaction from the second round as asymmetrical, and tilted to the downside. A win by Macron is already largely expected and thus, any further upside in EUR in this case may be relatively modest. On the other hand, a potential Le Pen victory would come as a major surprise for markets, and is likely to lead to significant downside in EUR.

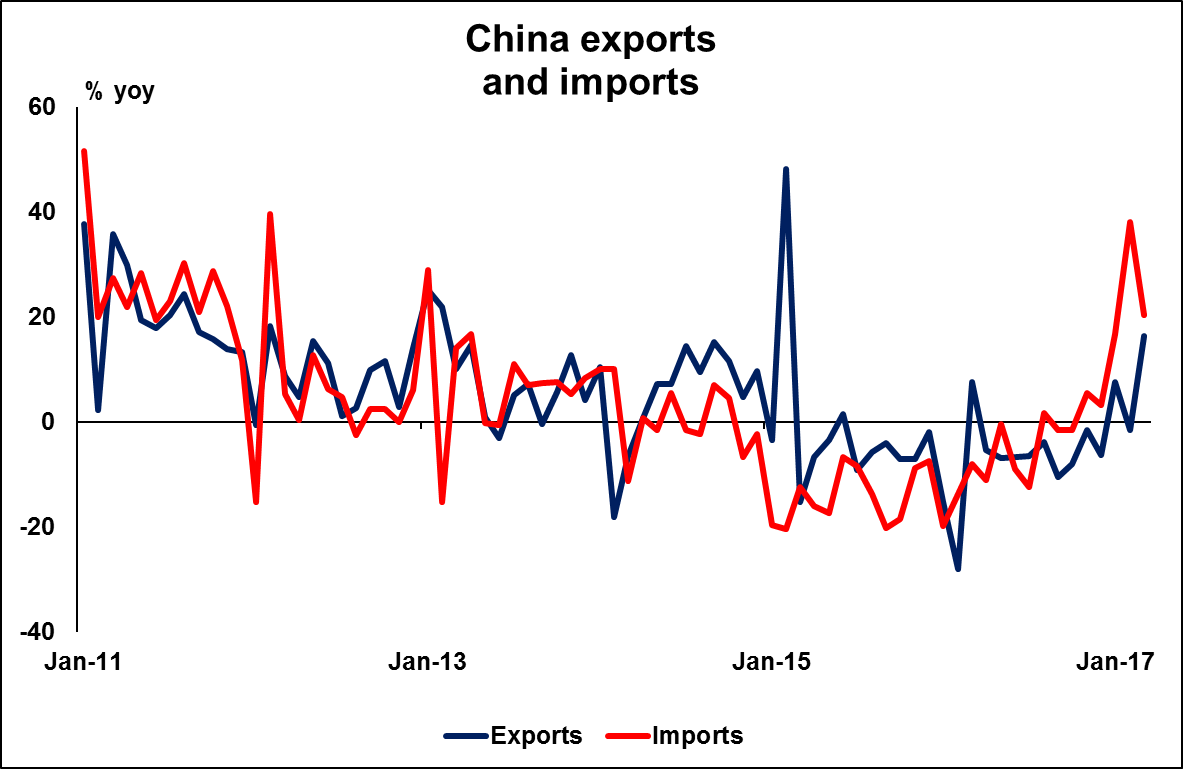

On Monday, during the Asian day, we get China’s trade data for April. The forecast is for both exports and imports to have risen again, though at a slower pace than previously. The exports forecast is supported by the nation’s official and Caixin manufacturing PMIs for the month, which showed that although new orders from abroad continued to rise, their growth rate slowed. As for imports, the aforementioned surveys support a slowdown here as well. In addition, recent media reports that the nation’s iron ore imports slowed notably in April add further validity to this prospect.

On Tuesday, we have no major events or indicators on the economic agenda.

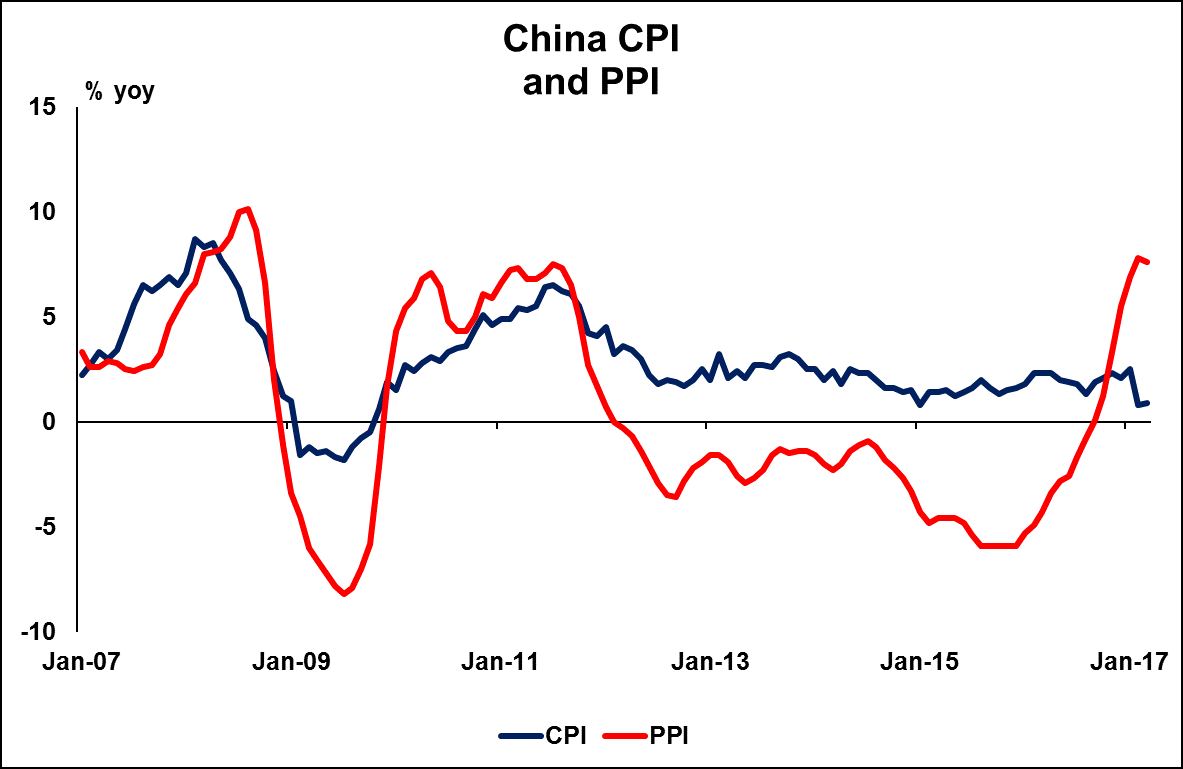

On Wednesday, during the Asian morning, China’s PPI and CPI data for April are due out. Expectations are mixed, with the CPI rate anticipated to have risen somewhat, while the PPI rate is forecast to have declined, though such a drop would still leave it at a very elevated level. We see the risks surrounding the CPI forecast as tilted somewhat to the downside, considering that the Caixin manufacturing PMI showed that both input inflation and final product inflation eased to multi-month lows in April.

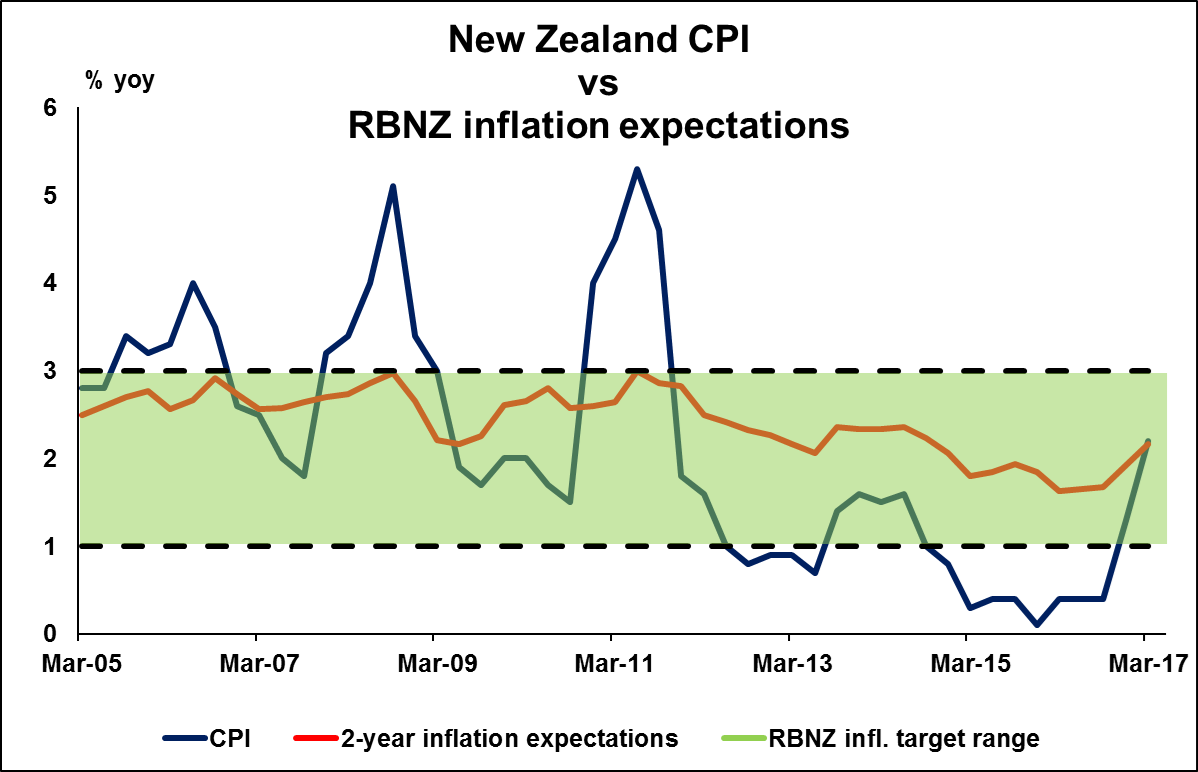

On Thursday, the RBNZ will announce its rate decision in early Asian time. In the absence of a forecast, we see the case for the officials to take no action again. The Bank kept the door for further easing wide open when it last met, indicating that numerous uncertainties persist, particularly in the global outlook, and that policy may need to adjust accordingly. As for inflation, the RBNZ noted that it expects it to reach the midpoint of the target over the “medium-term”. Nevertheless, inflation data for Q1 released shortly after that meeting were particularly strong, showing that CPI inflation is already above the midpoint of that range, and much higher than what the RBNZ expected in its own forecasts. Perhaps more importantly, 2-year inflation expectations rose further, and also lie safely above the midpoint of the range. Meanwhile, the labor market continued to tighten in Q1.

Even though all of these encouraging domestic developments should normally see the RBNZ shift to a somewhat more upbeat tune, we think that any optimistic message will be moderate, trying not to tip the scale too much. The Bank could keep the prospect of further easing on the table, and continue to quote global uncertainties as the reason. Concerns over global trade remain elevated, as we were reminded of recently by the US imposing tariffs on Canada. In addition, we believe that the Bank will not want to risk a speculative surge in NZD by appearing too optimistic, as that could offset some of the economic progress achieved so far.

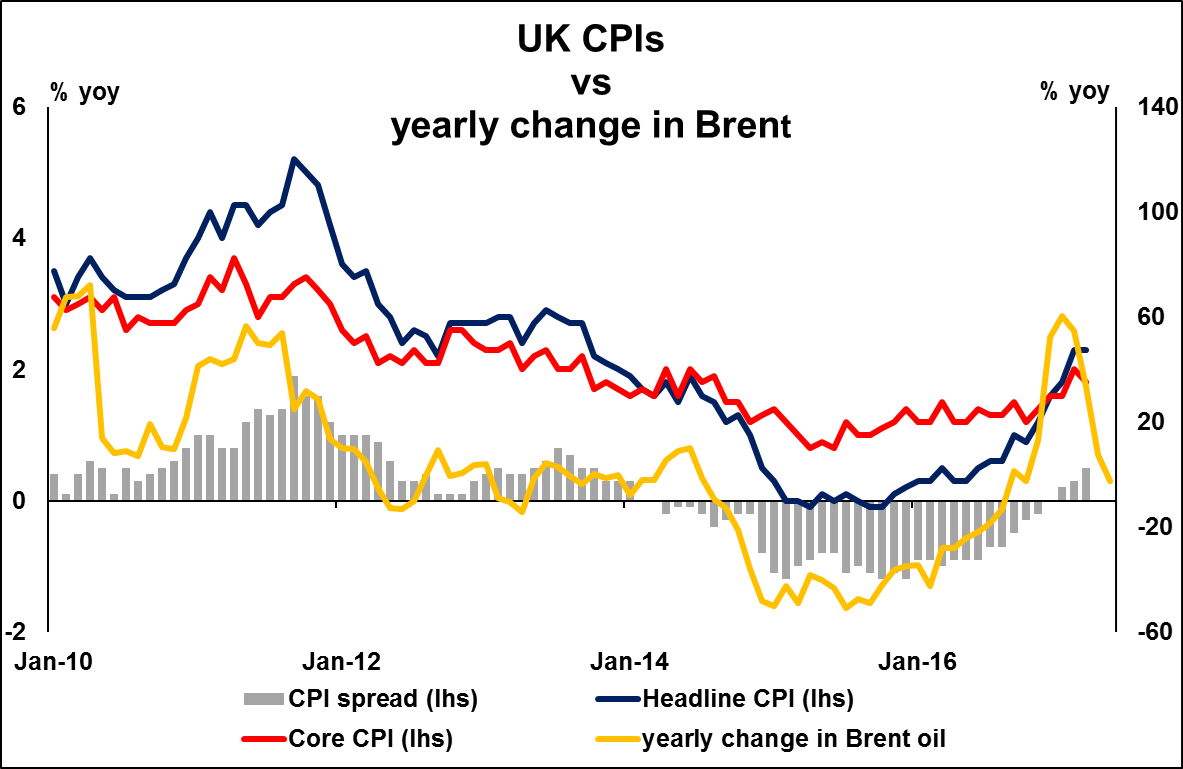

Later, during the European day, the Bank of England policy decision will be in the spotlight. This will be a “Super Thursday” meeting, meaning that besides the rate announcement and meeting minutes, we will also get the quarterly Inflation Report with updated economic forecasts for the UK economy. Governor Carney will present the report at a press conference after the gathering. The BoE added a hawkish touch the last time it met. Kristin Forbes dissented the decision to remain on hold, favoring an immediate rate hike instead. On top of that, the meeting minutes showed that “some members” would consider a reduction in monetary stimulus, should there be any further upside news on the prospects for growth or inflation. Since that gathering, data on these two fronts have been mixed. The core CPI rate rose further, but GDP growth slowed notably in the first quarter of the year.

Therefore, the Bank now has a choice to make. Maintain the hawkish touch it added last time and attribute it to rising inflation, or shift to a more cautious stance and place more emphasis on supporting economic activity. We believe that the Bank is likely to choose the second path, which is in line with its view that above-target inflation entirely reflects the drop in sterling and is thus transitory. As such, even though Forbes could be the lone dissenter again, we think that the overall tone of the Committee may be somewhat more concerned than previously.

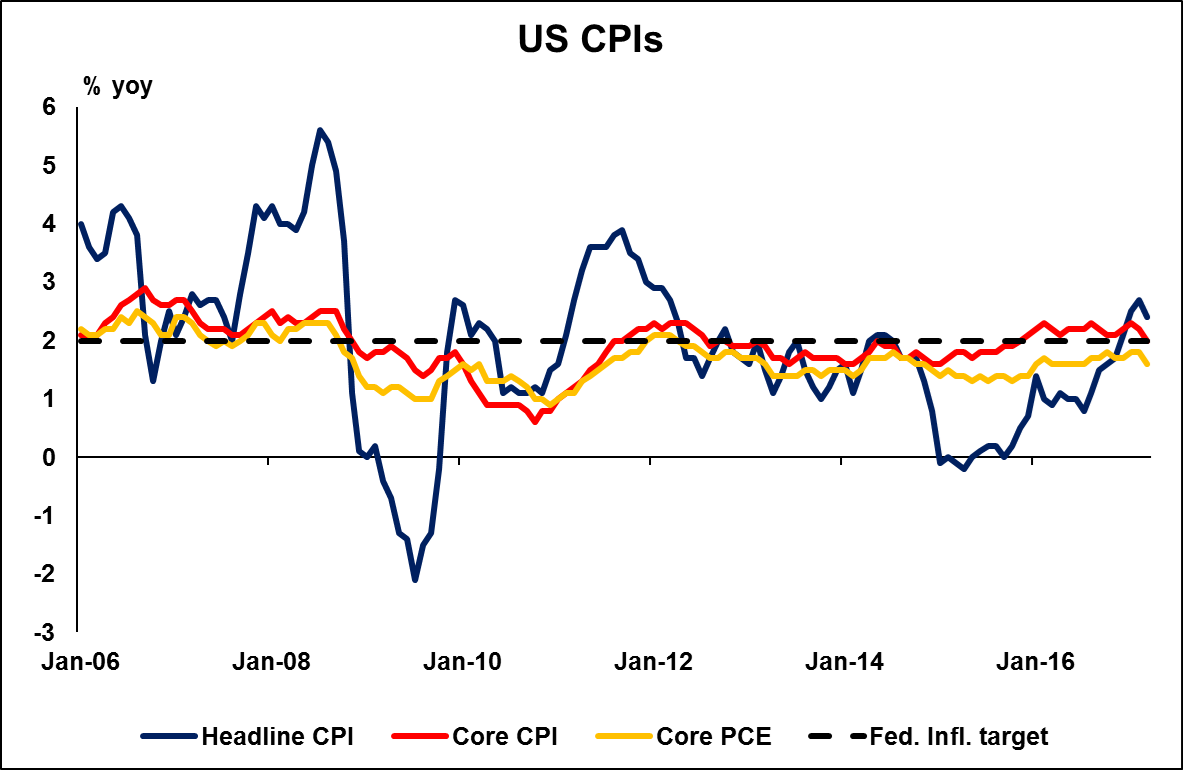

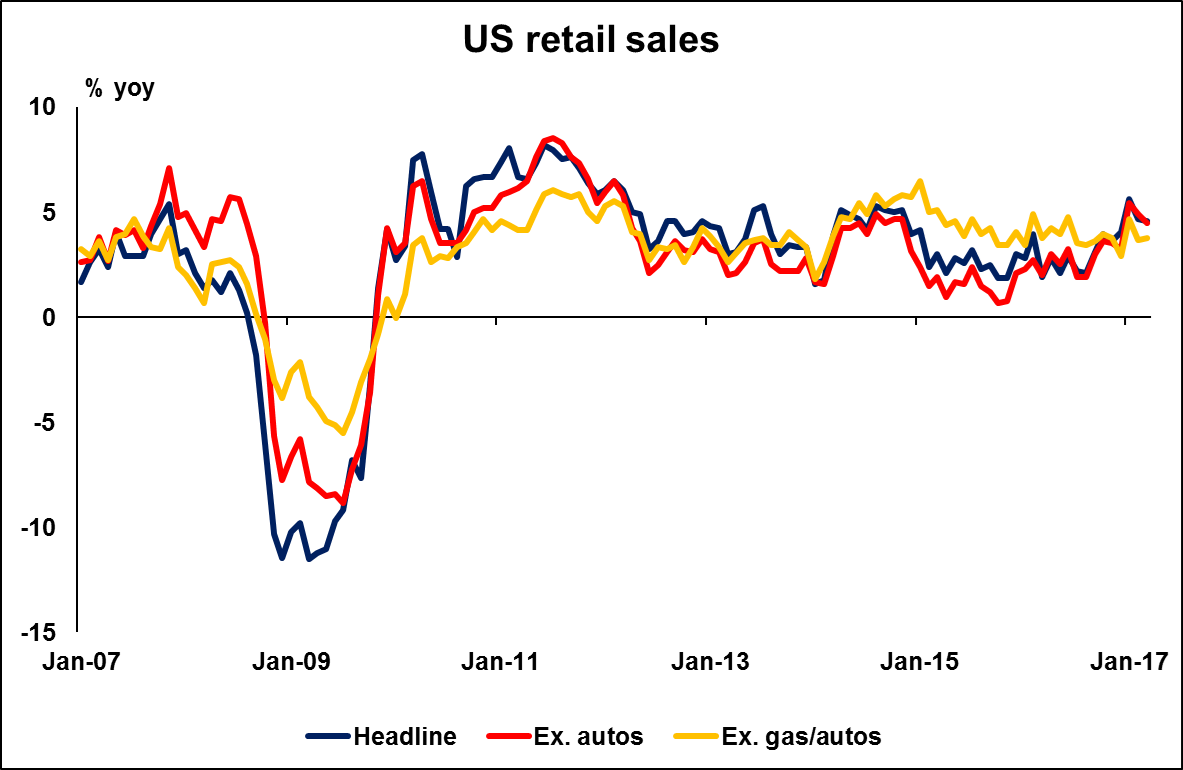

On Friday, we get US retail sales and CPI data, both for April. Kicking off with retail sales, both the headline and core rates are expected to have risen notably in monthly terms. Following two consecutive months of soft prints, we think that a rebound would be encouraging news for FOMC policymakers, who at their latest policy gathering noted they expect GDP growth to pick up speed in Q2. Strong retail sales could be a sign the US economy entered Q2 on a solid footing, and may thereby amplify speculation regarding a June rate hike even more.

As for the CPI data, no forecast is available. Our own view is that both the headline and the core rates may have remained unchanged, with risks skewed to the downside. We base that view on the nation’s Markit services PMIs for the month. Even though the manufacturing index showed that manufacturers raised the prices of final products at the fastest pace for almost two-and-a-half years, the report of the service sector, which accounts for a far larger percentage of the economy, indicated that providers raised their own charges at the slowest rate for five months.