Comentário Diário | 18/05/2017

USD carnage continues; spills over into equities

• The US dollar continued to collapse yesterday, with the USD index reaching its lowest level since November amid heightened uncertainty on the US political front. The recent media reports suggesting President Trump attempted to interfere with an FBI investigation have weighed significantly on risk sentiment, evident by the surge in safe haven assets, as well as the dip in global equity markets.

• We stick to our guns that this market sentiment could continue over the next few days. We base our view on the elevated market skepticism over Trump’s ability to push his tax plans through Congress, as well as the fact that there is nothing major on the US economic calendar to distract investors from these political developments until the release of the FOMC minutes next Wednesday.

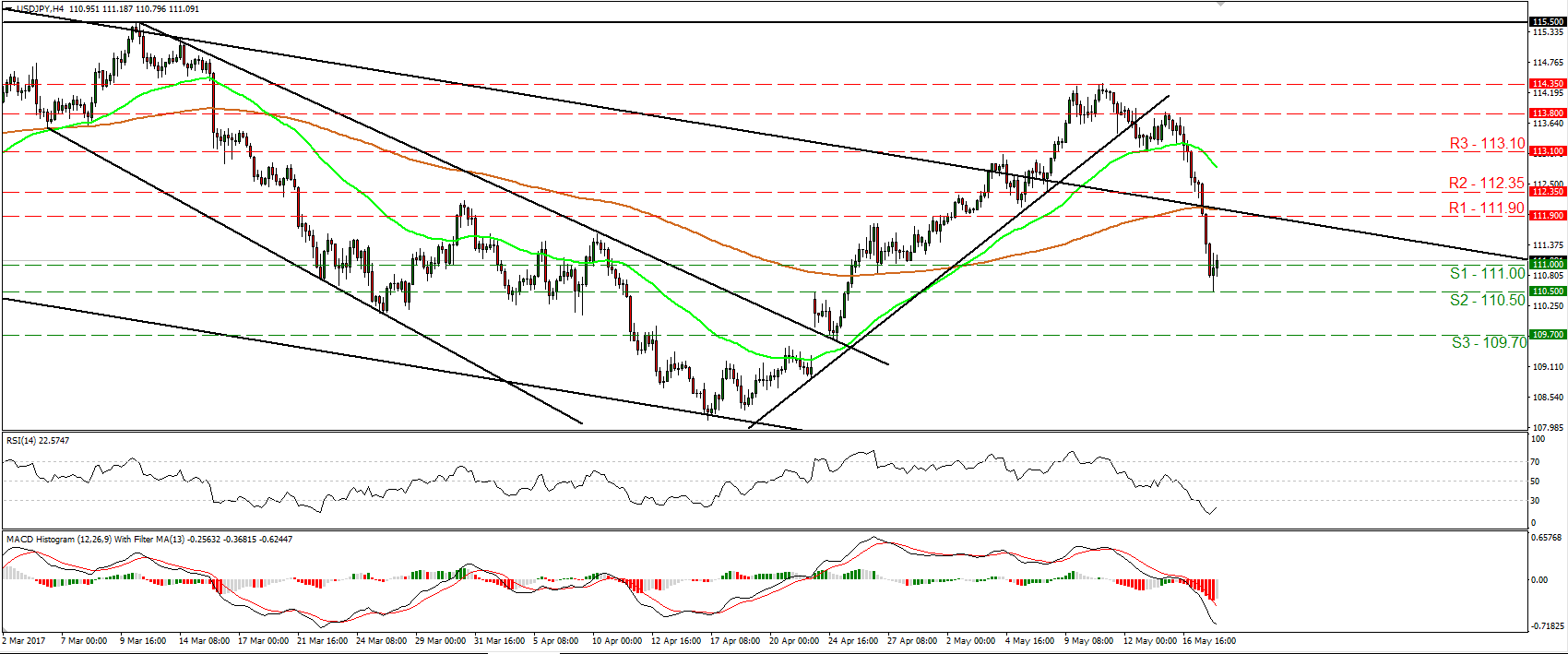

• USD/JPY continued to tumble yesterday, falling below the support (turned into resistance) of 111.90 (R1). The plunge brought the rate back within the medium-term downside channel that has been in place since December. Despite the corrective rebound following a test at 110.50 (S2), the fact that we are back within that channel increases the possibilities for the bears to take the reins again soon and perhaps aim for another test near 110.50 (S2). For now though, we stay cautious that the current corrective bounce may target the 111.90 (R1) barrier as a resistance this time.

Strong employment data lift AUD

• Overnight, Australia’s jobs data for April showed that the nation enjoyed a second consecutive month of strong employment gains. The unemployment rate unexpectedly declined to 5.7% from 5.9% previously, while the labor force participation rate remained unchanged, beating the consensus for a tick down. Meanwhile, the net change in employment was much higher than anticipated. As a result, the Aussie surged on the release. We think that these encouraging prints are likely to alleviate some of the RBA’s concerns regarding the labor market, which according to its May meeting minutes, the Bank was “carefully monitoring”.

• AUD/USD traded higher overnight, breaking above the resistance (now turned into support) barrier of 0.7445 (S1). Although the recovery started on the 11th of May is possible to continue for a while, as long as the rate continues to trade below the downtrend line taken from the 30th of March, I would treat it as a corrective move. We see the case for sellers to pull the trigger near the crossroad of the aforementioned downtrend line and the 0.7500 (R1) territory. In order for us to get confident on further upside extensions, we would like to see a decisive close above that crossroad.

Today’s highlights:

• During the European day, we get UK retail sales data for April. The forecast is for both the headline and the core figures to have rebounded, following a sharp decline the previous month. The forecast is supported by the BRC retail sales monitor, which skyrocketed to +5.6% yoy in April from -1.0% yoy previously. In addition, the fact that the TR/IPSOS and the Gfk consumer sentiment indices both rose during the month, enhances the argument for a rebound in sales. Such a rebound could ease some of the BoE’s concerns that household consumption appears to be slowing and thus, bring GBP under renewed buying interest.

• From the US, we get the Philly Fed manufacturing index for May and expectations are for another decline. Something like that could raise some speculation for a similar reaction in the ISM manufacturing index, which could extend USD’s recent losses. We also get the nation’s initial jobless claims for the week ended on May 12th.

• We have three speakers on the agenda: ECB President Mario Draghi, ECB Executive Board member Sabine Lautenschlager and Cleveland Fed President Loretta Mester. We think that market participants are likely to focus primarily on Draghi’s comments, amid elevated speculation that the ECB may appear slightly more optimistic at its upcoming meetings. Any such hints could bring the euro under renewed buying interest.

USD/JPY

• Support: 111.00 (S1), 110.50 (S2), 109.70 (S3)

• Resistance: 111.90 (R1), 112.35 (R2), 113.10 (R3)

AUD/USD

• Support: 0.7445 (S1), 0.7385 (S2), 0.7330 (S3)

• Resistance: 0.7500 (R1), 0.7550 (R2), 0.7600 (R3)