Comentário Diário | 17/05/2017

Greenback continues to slip amid political turmoil

• The greenback extended its recent losses yesterday, amid renewed political turmoil in Washington DC. The latest media reports suggest that President Trump asked former FBI Director Comey to drop an investigation regarding ties between Trump’s prior security advisor Michael Flynn and Russia. Considering that Trump recently fired Comey, this development raises a lot of questions, and thus uncertainty for investors. Can the President be impeached over this? Even if not, does this diminish some of Trump’s political capital, thereby making it less likely that he manages to push his tax-reform agenda through Congress? Thus, will the dollar continue to feel the heat of all this turmoil?

• In our view, even though we may see the greenback recovering some of its losses today following its sharp tumble, we think that it is likely to remain on the back foot over the next few days. This view is supported by the fact that there are no major US indicators on the economic calendar this week, and very few Fed speakers to distract market participants from the political front. Our favorite proxy for further USD weakness remains EUR/USD, bearing in mind the continued strength in Eurozone data, and speculation that the ECB may appear slightly more optimistic at its upcoming meeting in June.

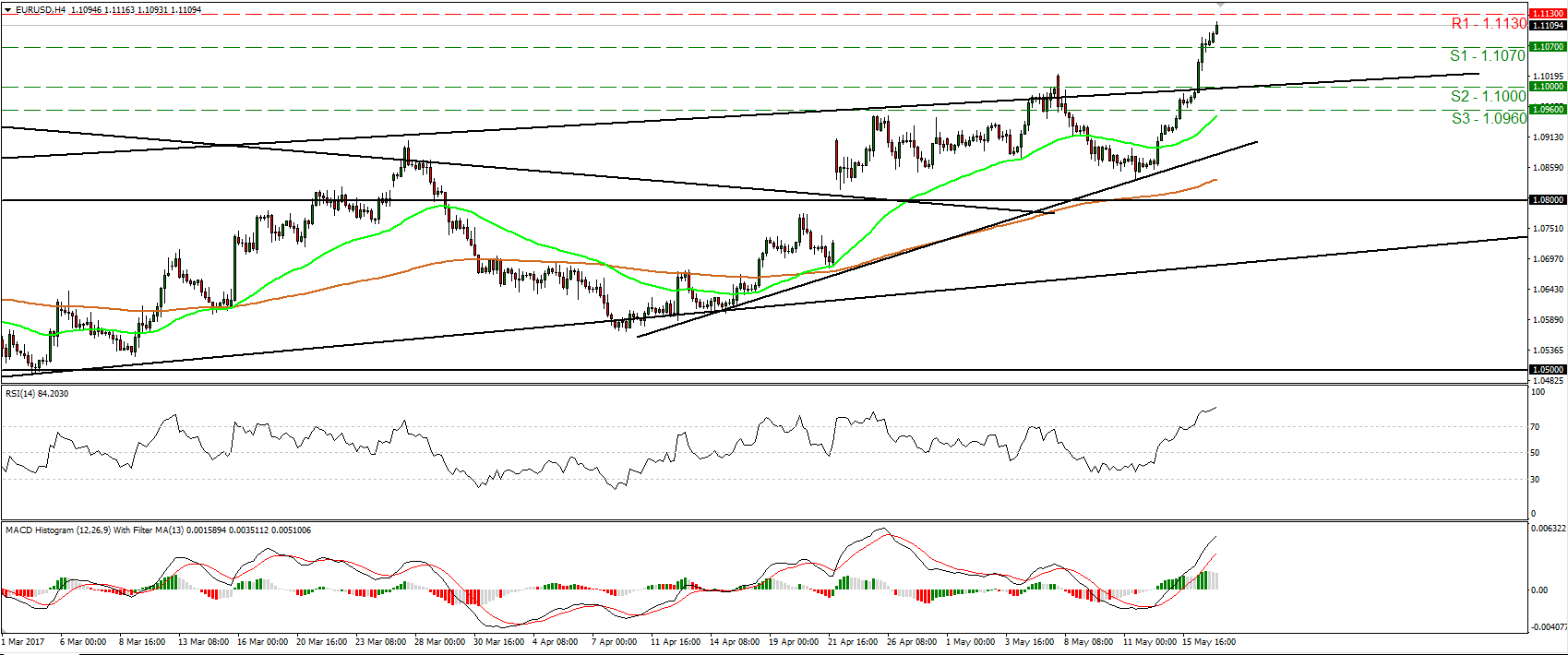

• EUR/USD surged yesterday, breaking above the psychological zone of 1.1000 (S2). At the time of writing, the rate looks to be headed for a test near the 1.1130 (R1) resistance zone, where a clear breach is possible to pave the way for our next obstacle of 1.1240 (R2). Nevertheless, given that the rally appears too steep, we would stay mindful that a corrective setback may be on the cards before the bulls decide to take charge again.

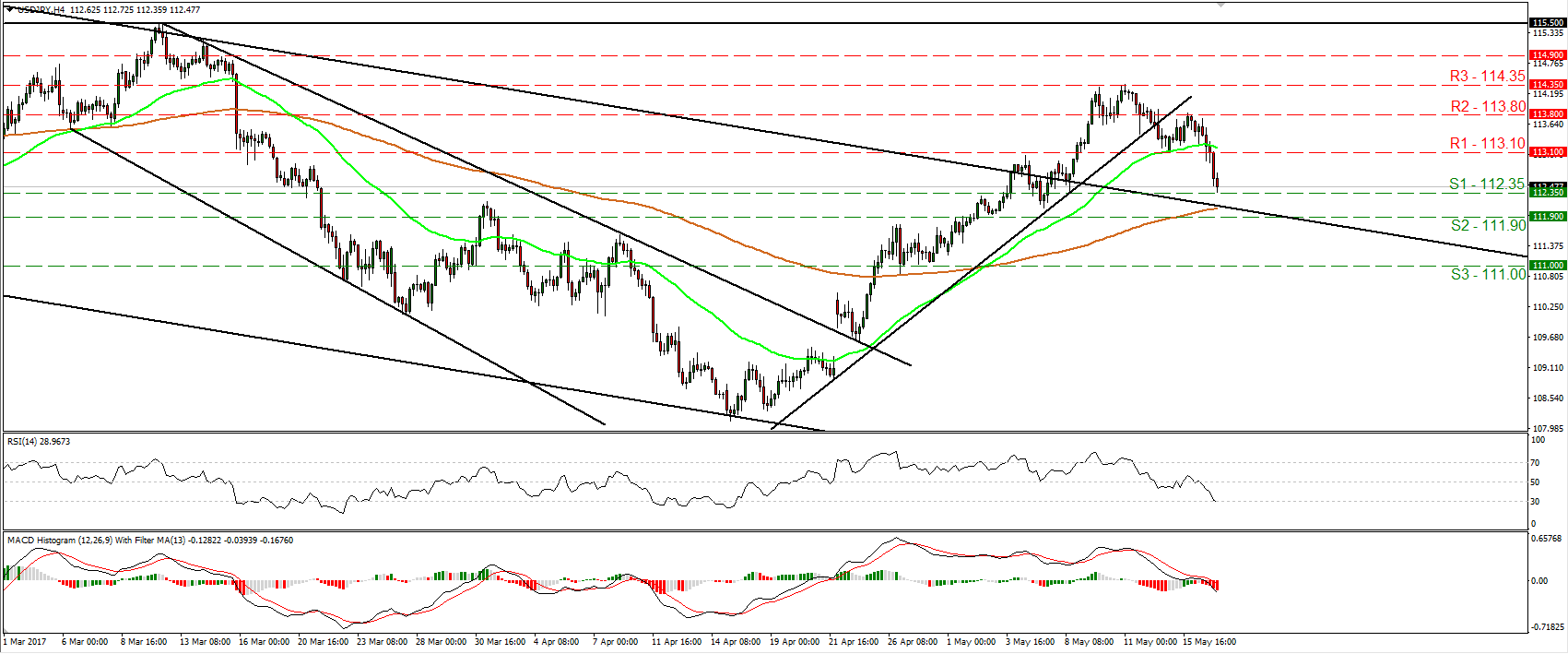

• USD/JPY tumbled and fell below the support (now turned into resistance) of 113.10 (R1). Now, the rate is testing the 112.35 (S1) support obstacle, which lies slightly above the upper bound of the medium-term downside channel that contained the price action from December until the beginnings of May. Although we expect the dollar to remain weak against the euro, here we prefer to stay neutral for now as there is the possibility of a rebound from near the aforementioned line. We prefer to wait for a dip below 111.90 (S2) before we get confident on larger bearish extensions. Something like that will bring the pair back within the abovementioned channel and is possible to initially aim for the 111.00 (S3) support zone.

Today’s highlights:

• During the European day, the UK employment data for March are coming out and the forecast is for the unemployment rate to have held steady. Average weekly earnings excluding bonuses are expected to have risen at the same pace as previously, while the figure including bonuses is forecast to have accelerated. Our own view is that both of the earnings rates may have risen, considering the UK services PMI for the month, which showed that firms reported stronger salary pressures. In case nominal UK wages accelerate, real wages could turn back positive given the steady inflation rate during the month. Something like that could ease some of the BoE’s concerns regarding falling real wages and thereby bring GBP under renewed buying interest.

• In Eurozone, the final CPI for April is due out, but as the final figure is expected to confirm the preliminary estimate, the reaction in EUR may remain muted.

• From Canada, we get manufacturing sales for March. The forecast is for a rebound, something that may support CAD somewhat.

• We have only one speaker on the agenda: BoE MPC member Andy Haldane.

EUR/USD

• Support: 1.1070 (S1), 1.1000 (S2), 1.0960 (S3)

• Resistance: 1.1130 (R1), 1.1240 (R2), 1.1300 (R3)

USD/JPY

• Support: 112.35 (S1), 111.90 (S2), 111.00 (S3)

• Resistance: 113.10 (R1), 113.80 (R2), 114.35 (R3)