Comentário Diário | 03/05/2017

FOMC: Will they pave the way for a June hike?

• Today, all eyes will be turned to the FOMC rate decision. The forecast is for the Committee to keep borrowing costs unchanged, something supported by market pricing, which indicates a 95% probability for no action. Bearing also that this meeting does not include updated forecasts or a press conference, market action will most likely come from the language of the statement accompanying the decision.

• Recent comments from various Fed officials are in line with the “dot plot”, which points to another two hikes this year. However, these were before the nation’s core inflation data for March revealed a slowdown. From a growth perspective, economic activity slowed markedly in Q1, but according to the March minutes, the Committee views some of this softness as transitory. On the bright side, the labor market appears quite robust overall.

• Bearing these mixed data in mind, we expect the Fed to maintain a more or less balanced tone, with risks tilted towards a slightly more cautious narrative than previously. Before clearly communicating that further near-term normalization is on the cards, policymakers may prefer to wait for a rebound in the data and even some clarity surrounding fiscal policy. In case the Fed disappoints investors looking for strong hints regarding a June hike, USD could come under selling interest.

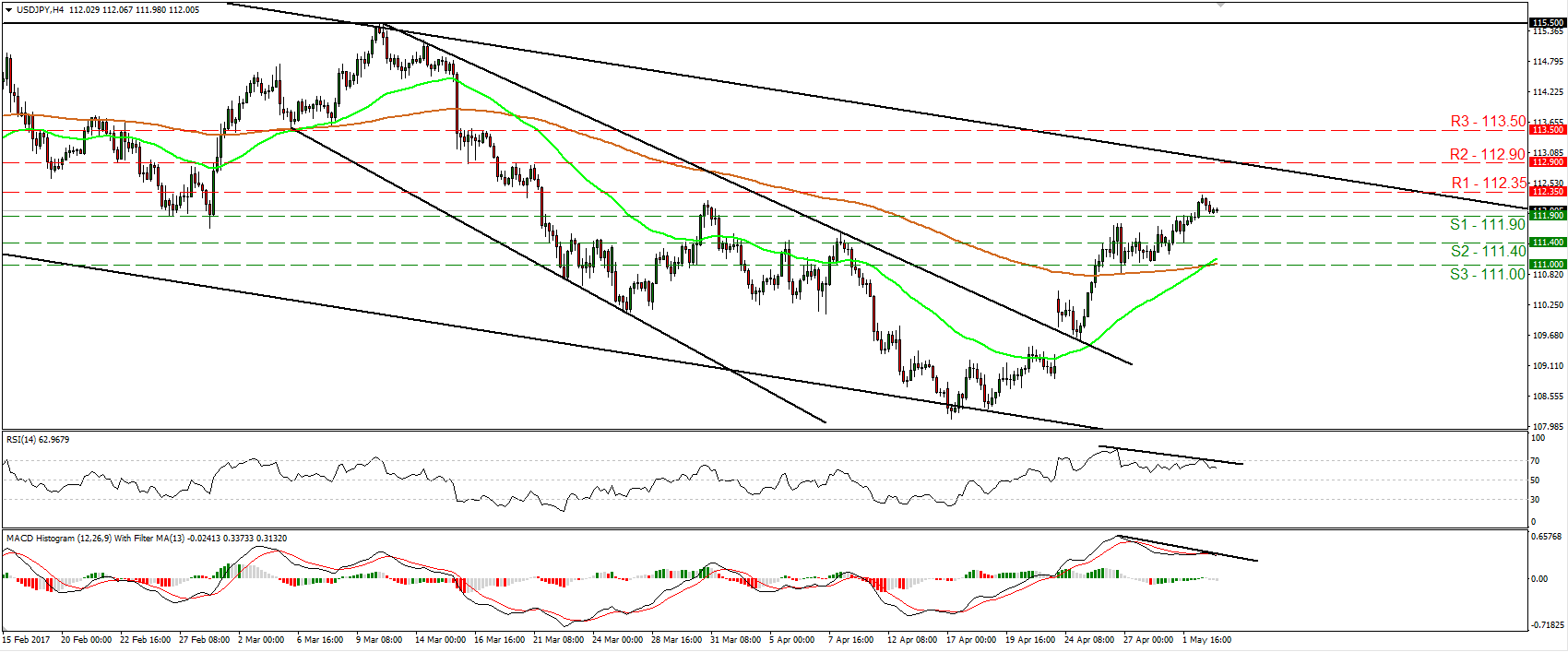

• USD/JPY has been trending higher since the 18th of April, but the trend shows signs of weakening momentum recently. Now, the rate is trading between the support of 111.90 (S1) and the resistance of 112.35 (R1), and we expect it to continue trading near that range heading into the FOMC decision. In case the Fed adopts a more cautious stance than previously, the pair may slide below 111.90 (S1), initially aiming for the next support of 111.40 (S2). Switching to the daily chart, we see that the pair continues to trade within the downside channel that has been containing the price action since the start of the year. The proximity to the upper bound of that channel combined with the slowdown of the latest recovery, amplify the case for the pair to turn down again soon.

NZD spikes higher on strong employment data • Overnight, the Kiwi dollar came under buying interest following the release of the nation’s employment data for Q1. The report was quite strong, with the unemployment rate unexpectedly dropping and the labor force participation rate rising. These suggest that the labor market continues to tighten at a rapid pace. Coming on top of the solid inflation figures for the same quarter, we think that these data enhance the case for the RBNZ to appear less dovish than previously when it meets next week.

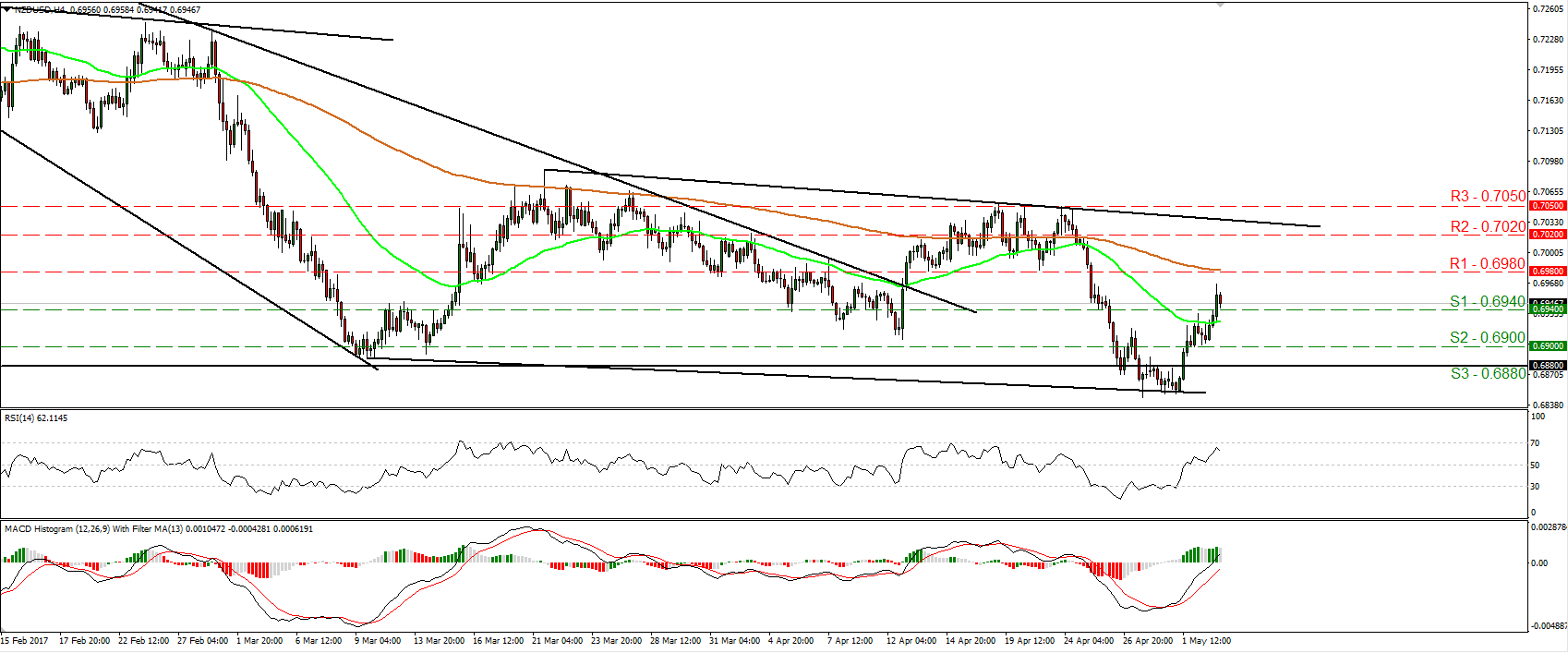

• NZD/USD edged up on the employment data, breaking above the resistance (now turned into support) of 0.6940 (S1). The latest recovery started from near 0.6880 (S3), which happens to be the lower bound of the longer-term sideways range between that zone and the 0.7400 territory. Therefore, there is the possibility for the pair to continue trading higher for a while, at least heading into next week’s RBNZ gathering. We expect the bulls to challenge the 0.6980 (R1) resistance soon, where a clear break is possible to target the 0.7020 (R2) hurdle and the downside resistance line drawn from the peak of the 21st of March.

As for the rest of today’s highlights:

• During the European day, the UK construction PMI for April is expected to have declined somewhat. However, following the unexpected surge in the manufacturing index for the month, we see the risks surrounding that forecast as skewed to the upside. In case of a positive surprise, GBP could come under renewed buying interest.

• From Eurozone, we get the flash preliminary estimate of GDP for Q1. We also get the bloc’s PPI for March, as well as Germany’s unemployment rate for April.

• As for the US data, we get the ADP employment report for April and the ISM non-manufacturing PMI for April. The ADP figure is expected at 190k, a solid number, while the ISM index is expected to have risen. Even though USD could gain on these data, its direction over the next couple of days may be primarily decided by the FOMC signals.

USD/JPY

• Support: 111.90 (S1), 111.40 (S2), 111.00 (S3)

• Resistance: 112.35 (R1), 112.90 (R2), 113.50 (R3)

NZD/USD

• Support: 0.6940 (S1), 0.6900 (S2), 0.6880 (S3)

• Resistance: 0.6980 (R1), 0.7020 (R2), 0.7050 (R3)