Next week’s market movers

• On Monday, no major financial releases are expected.

• Japan’s unemployment rate for April, as well as the US CB consumer confidence indicator for May could be the center of discussion on Tuesday.

• In a rather busy Wednesday, Japan’s retail sales for April, Germany’s unemployment data and preliminary HICP rate for May, Eurozone’s consumer confidence for May, the US ADP employment figure for May and the 2nd release of the GDP growth rate could move the market on Wednesday. The star of the day though, should be Bank of Canada’s (BoC) interest rate decision.

• On Thursday, China’s NBS Manufacturing PMI for May, Germany’s retail sales for April, Eurozone’s preliminary inflation rate for May and Canada’s GDP growth rate will be released.

• Last but not least, on Friday, the market could shift its focus primarily to the US employment report for May with its NFP figure, but also the US ISM manufacturing PMI for May could get some attention.

In the next week a plethora of financial data releases could attract the market’s attention. Our team chose and concentrated on the ones which it considers as the most influential and discusses their possible forecasts and their respective effects on various currencies.

On Monday, no major financial releases are expected.

On Tuesday, during the Asian morning we get Japan’s unemployment rate for April. The rate is forecasted to remain unchanged at 2.5% compared to previous month’s reading.

Should the actual rate meet the forecast we could see JPY strengthening as the low unemployment rate continues however the market’s reaction could be somewhat muted as the Japanese economy is used to such low unemployment rates.

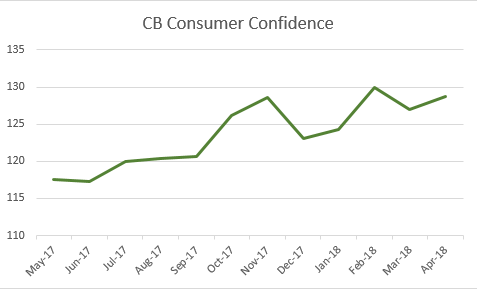

In the American session, the US CB consumer confidence indicator for May is due out. The figure is forecasted to drop to 128.0 compared to previous reading of 128.7.

Should the actual figure meet the forecast we could see the USD weakening somewhat. It should be noted though that despite the drop the indicator remains at relatively high levels.

On Wednesday, during the Asian morning Japan’s retail sales growth for April will be released. The rate is forecasted to remain unchanged at +1.0% month on month (mom) compared o previous months rate.

If the forecast is realized we could see the JPY weakening as the rate remaining in such low levels could imply to the market that consumer’s confidence in the market is at a decreased level and such a scenario would not generate new hopes for inflationary pressures.

In the European morning we get Germany’s unemployment data for May. The unemployment change figure is expected to reach -10k compared to previous reading of -7k, while the unemployment rate is forecasted to remain unchanged at 5.3% compared to previous reading.

Should the actual data meet the forecast we could see the EUR strengthening as the report shows a rather slightly tightening labour market for Eurozone’s largest economy which could provide in a later stage some inflationary pressures.

Later, we get Eurozone’s final release of the consumer confidence indicator for May. The figure is forecasted to tick down to 0.2 compared to previous reading of 0.3.

Should the actual figure meet the forecast we could see the common currency weakening as the indicator would take a downward trend again pretty near the negative sign.

Last in the European session, Germany’s preliminary release of the HICP rate for May is due out. The rate is forecasted to slowdown +1.4% year on year (yoy) compared to previous reading of +1.5% yoy.

Should the actual rate meet the forecast we could see the EUR weakening as the slowdown could imply a weakening of inflationary pressures in the Eurozone.

In the American session, we get the US ADP employment figure for May. The figure is forecasted to drop to 190k compared to previous reading of 204k.

Should the actual figure meet the forecast we could see the USD weakening as such a release could negatively influence the market towards the greenback ahead of the US employment report on Friday.

Also in the American session we get the 2nd preliminary release of the US GDP growth rate for quarter 1. The rate is forecasted to accelerate and reach +2.4% quarter on quarter (qoq) compared to previous reading of +2.3% qoq.

Should the actual rate meet the forecast we could see the USD strengthening as the GDP growth rate acceleration would be evident of the growing US economy.

Last but not least in the American session we get BoC’s interest rate decision. The bank is expected to remain on hold at +1.25% and currently CAD OIS imply a probability for the BoC to remain on hold at 62.34%, while another 37.66% implies a rate hike of 25 basis points (bp). We currently share the view that most likely the bank will remain on hold as despite the fact that the inflation rate is within the bank’s range, it could be the case that the bank will retain a more cautious tone and maybe tolerate the current inflation rate as it may be watching out for the uncertainty of the NAFTA negotiations, the high private debt level and the unemployment rate. Overall as the rate is forecasted to remain unchanged we could see the market’s attention turning to the accompanying statement. We see the case once more for a balanced tone, however we see risks skewed to the dovish side for this meeting and accompanying statement. It could be the case though, that the bank may surprise us in the second half of the year with two rate hikes with marginal chances existing in the December meeting for a second rate hike. In general, we see the case for the CAD weakening somewhat from the current interest rate decision.

On Thursday, during the Asian session we get China’s, NBS Manufacturing PMI for May. The indicator is forecasted to tick down and reach 51.3 compared to previous reading of 51.4.

Should the actual reading meet the forecast we could see the Aussie and the Kiwi weakening as such a drop could imply less Chinese imports from Australia and New Zealand. However the market’s reaction could be somewhat muted as the difference is rather small.

In the European session we get Germany’s retail sales growth rate for April. The rate is forecasted to accelerate reaching +0.8% mom compared to previous reading of -0.6% mom.

Should the actual reading meet the forecast we could see the EUR strengthening as the acceleration is substantial, the rate gets back a positive sign and overall the consumers in the largest Eurozone economy seem willing and able to place their money in the market.

Later on we get Eurozone’s preliminary release of the CPI rate for May. The rate is forecasted to remain unchanged at 1.3% mom compared to previous reading.

Should the actual rate meet the forecast we could see the EUR weakening as the rate remains steadily at low levels and thus not allowing the ECB to take a more hawkish stance towards its interest rate and the QE program.

In the American session, Canada’s GDP growth rate for Q1 is to be released. The rate is forecasted to accelerate and reach +2.0% qoq (annualized) compared to previous reading of +1.7% qoq (annualized).

Should the actual rate meet the forecast we could see the CAD strengthening as an acceleration of the GDP growth rate could imply a growing economy and more certainty for the BoC.

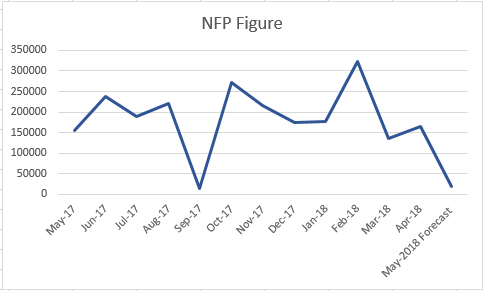

On Friday, in the American session the US employment report is due out. The unemployment rate is forecasted to remain unchanged at 3.9%, the average earnings growth rate are forecasted to remain also unchanged at +2.6% year on year (yoy) and the Non-Farm Payrolls figure is forecasted to rise to +185k compared to previous reading of +164k.

Should the actual data be realized we could see the USD strengthening as the report remains strong, and the increase in the NFP figure suggests that the labour market is tightening.

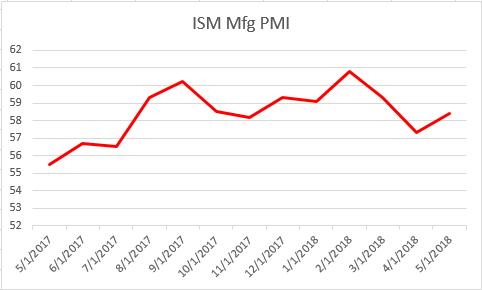

At the same time we get the ISM manufacturing PMI for May. The indicator is forecasted to increase and reach 58.4 compared to previous reading of 57.3.

Should the actual reading meet the forecast we could see the USD strengthening as the increase could imply an expansion of the US manufacturing sector.

Overall, should the forecasts of the employment report and the ISM Mfg PMI be realized, Friday should be a good day for the greenback but the market could start positioning itself earlier.