Week Ahead | 22/10/2018

Week ahead: October 22nd to 26th | Interest rate decisions could be the keynote of the week

As a new week begins the Brexit negotiations are expected to continue to dominate the headlines in the UK. On the west side of the Atlantic, the ongoing US-Sino trade conflict could move the markets, is contrast to the tensions in the US-Saudi relationships, which currently seem to be ignored by the market. In the European political theatre, the Italian budget drama seems to be continuing and could escalate further as both sides seem to be digging into their positions ready for a fight. For a closer look of all of that, along with this week’s financial releases, you can go through this week’s outlook.

US Dollar- From Beijing to Riyadh and in the center the US GPD%

With recent headlines made about the admittance (on behalf of Saudi Arabia), of the death of Washington Post’s columnist (Saudi national) Khashoggi, one could expect the issue to continue into this week. The issue as such though seems to test the more the ethics of the US rather than the markets. As US president Trump warned that consequences could be severe for the Saudis, the issue remains very open and despite recent de-escalation, further developments could affect markets and especially oil markets.

In the US-Sino conflict, developments could also be expected as media show that officials between the two countries are in touch, however Reuters claims in one of its articles that the US economic policy toward China is to get tougher, according to an economists poll. After the recent release of China’s soft financial data (GDP and Industrial production), the plot gets an interesting twist as to how effective, the US tariffs actually are. Also no one can exclude a possible spillover of the issue to other subjects.

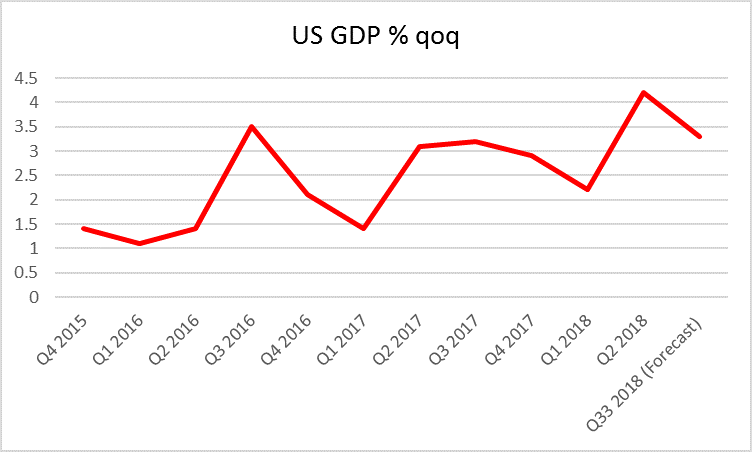

Last but not least, in the financial releases spectrum the US GDP growth rate is expected to be released near the end of the week and it is forecasted to slowdown, reaching +3.3% qoq (annualized) if compared to the final release of Q2’s data that had a reading of +4.2% qoq. Should the actual rate meet its respective forecast we could see the USD weakening, as the slowdown of the GDP growth rate could imply lesser economic activity in the US.

GBP- UK at a Brexit crossroad

The pound is expected to be extensively Brexit driven this week, as only few and of medium to low impact financial releases are expected. The Brexit negotiations had reached another dead-end during the EU summit in Brussels. The two sides seem to flirt with the idea of prolonging the period in which the UK remains under the EU’s full membership rules after December 2020, in order to provide more time for the deadlock to be broken. It should be noted though, that recent comment and media headlines imply that the UK government may be willing to easy their red lines regarding the Irish backstop issue and such a development could provoke anger among hard Brexiteers in the UK parliament. From the EU side, chief negotiator Michel Barnier lightened the optimistic side of the negotiations as he stated that a Brexit deal is by 90% done, however at the same time, warned that the Irish border issue could derail it. In any case, further developments in the Brexit negotiations could be expected and political instability in the inner UK political scene could also prove to be a substantial market mover for the pound.

EUR- Apart from the Italian budget issue, financial releases and ECB’s interest rate decision could set the tone for the EUR.

The Italian Budget issue is expected to influence the common currency’s direction also in the current week. After the recent headlines made from the confrontation of the EU with Italy over the issue in the Euro summit, measures may be taken from Brussels. Criticism seems to consist of remarks about planned government spending being too high, structural deficit expected to rise instead of falling and that Italian public debt would not drop. The EU seems to consider it as a “particularly serious non-compliance” and its deviation from targets as “unprecedented”, according to media. At this point we would like to underscore the word “unprecedented”, as in the past Brussels had tolerated deviations, hence implying that this time action could be taken. It should also be noted, that within the Italian political scene frictions seem to escalate, between the 5 Star Movement and the League, destabilizing further the situation. The new issue of controversy seems to be a planned tax amnesty clause which the 5 Star Movement strongly opposes to. As Brussels and Italy seem to dig into their positions, analysts point out, that the Euro decline reflects the political tension in the Eurozone. At the same time in the German political theater, all parties are in a race for the local elections at the state on Hessen, however that will occur on Sunday the 28th with any effects taking place the following week.

As for financial releases, the market’s focus could be on ECB’s interest rate decision on Thursday, during the European session. The bank is forecasted to remain on hold at 0.0% and currently EUR OIS imply a probability for the bank to remain on hold of 94.96%, rendering the decision as an open and shut case. We could see the bank making some hawkish comments regarding the inflation rate though as it seems to stabilize slightly above the bank’s 2.00% yoy target currently. Also comments could be made regarding the unwinding of the banks’ QE program. Please be advised that the following press conference could also provide volatility for EUR pairs.

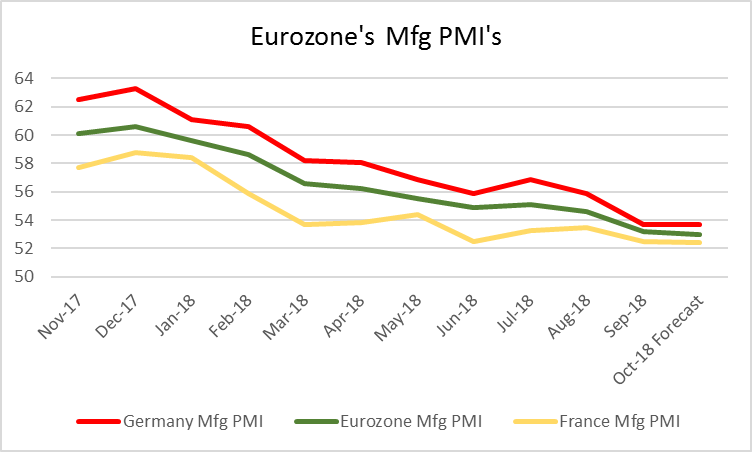

Besides ECB’s interest rate decision, number of financial releases also affecting the common currency are to be released next week. Starting with Monday, during the American session we get the preliminary release of Eurozone’s Consumer Confidence indicator for October. The indicator is forecasted to tick down reaching -3.0 if compared to previous reading of -2.9 and should the forecast be realized we could see the EUR losing ground. Similar effects are expected from the release of Germany’s GFK Consumer climate for November (forecast:10.5 vs. prior:10.6), Germany’s Ifo business climate for October (forecast: 103.2 vs. prior:103.7) and the preliminary releases of the Eurozone’s, Germany’s and France’s preliminary PMI’s for October, with the most characteristic being Germany’s Manufacturing preliminary PMI for October (forecast: 53.4 vs. prior:53.7). Overall, should the actual readings of the prementioned financial releases meet their corresponding forecasts, we could see a bearish mood settling, over the single currency’s direction.

CAD-TRY-SEK-NOK Central bank interest rate decisions to be the highlights of the week.

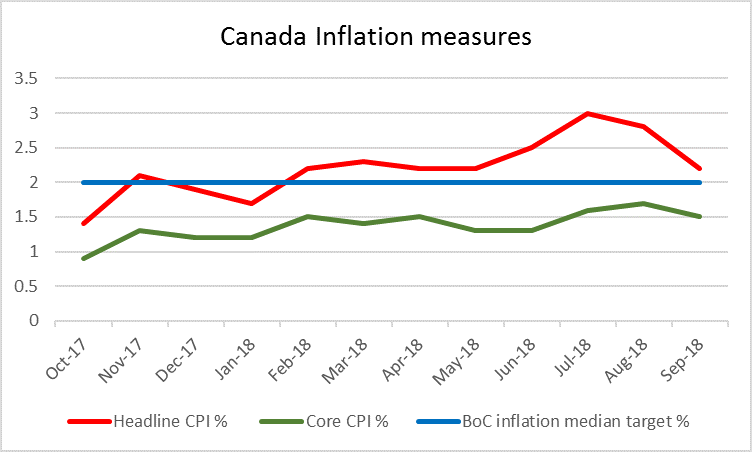

Starting with Canada, the BoC is to announce its interest rate decision in the American session on Wednesday. Given Friday’s CPI releases with the headline CPI rate slowing down substantially (Sep: + 2.2% yoy vs. Aug: +2.8% yoy) as well as the core CPI rate (Sep: +1.5% yoy vs. +1.7% yoy), we could be in for a very interesting decision from the BoC.

Currently (after the release of the inflation rates), CAD OIS seem to be holding and continue to imply for the scenario of a 25 basis points rate hike a possibility of 96.95%. Should the rate hike be delivered, interest rates would be elevated to reach +1.75%. It should be noted though that the bank was quite data driven in the past. Bear in mind, that the bank is one of the few, which has already “normalized” its policy, has hiked rates over three times since the beginning of 2017 and seems to be set to deliver another one. Should the rate hike take place as planned we could see the Loonie getting some support, unless there is a dovish accompanying statement.

Moving to Scandinavia, Norway’s Norges bank is expected to remain on hold on Thursday, by a number of analysts, after the recent rate hike of 25 basis points and lifting the rates to +1.75%, was the first in a number of years. Despite the financials of Norway supporting another rate hike, next rate hike is expected beginnings of 2019. Should hawkish elements escape the bank’s accompanying statement, we could see the NOK getting some support.

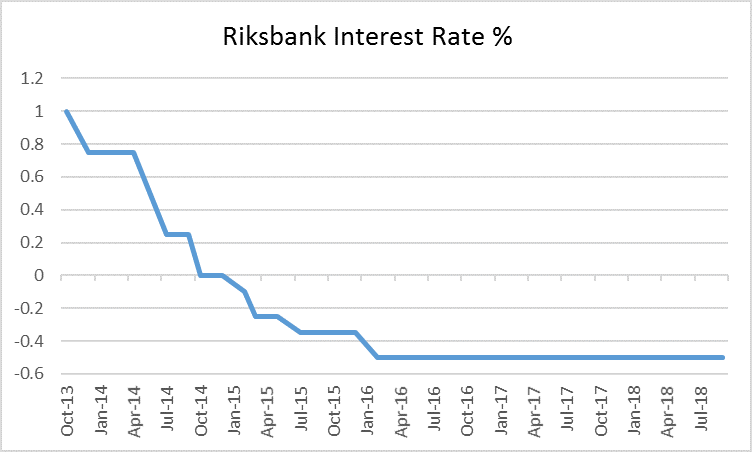

Staying in Scandinavia, Sweden’s Riksbank is expected to release its own interest rate decision on Wednesday morning. The bank is expected to remain on hold at -0.50% and currently SEK OIS imply a probability for the bank to do so of 98.26%. With a CPI rate staying above the bank’s target of +2.00% yoy, we could see some hawkish elements supporting the Krona in the accompanying statement however the next rate hike may have to wait probably for the end of 2018 or beginnings of 2019.

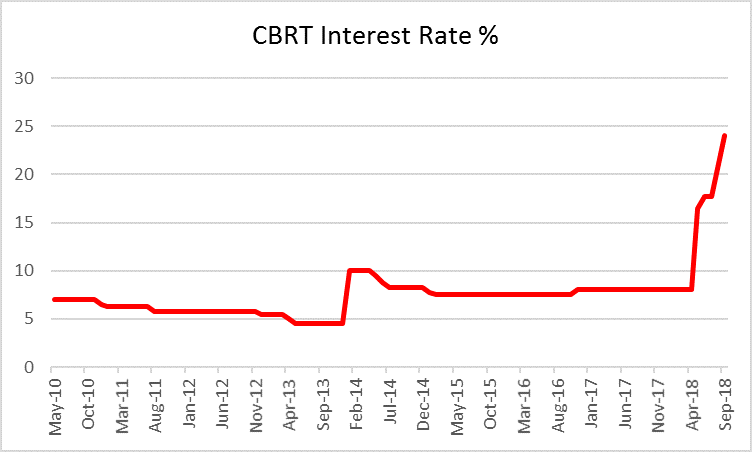

Moving on to Turkey, the CBRT is expected to release its interest rate decision on Thursday and some analysts point out that a rate cut from current 24% to 22% would be possible. Any forecast at the current level could prove to be far-fetched and given that the inflation rate has accelerated, since the last meeting a rate cut would seem unlikely. We would share the view that the bank may keep its weekly repo rate unchanged at 24% as the inflation rate pushed higher in its latest release and while the bank may be waiting to see the effects of the relative calming of the Lira.