Week Ahead | 14/12/2023

March 13th – 17th | FOMC, BoE, BoJ, SNB & NB meetings, Dutch elections, key data in focus

• In the US, the FOMC is widely expected to raise rates. Given that such a move is almost fully priced in, market action may come from the updated signals regarding the rate path.

• In the UK, the BoE is forecast to stand pat. The focus will be on the officials’ outlook for inflation.

• The Bank of Japan, the Swiss National Bank, and the Norges Bank, are all expected to remain on hold as well.

• In Eurozone, political risk events commence with elections in the Netherlands.

• We also get key economic data from China, Sweden, the UK, the US, and New Zealand.

On Monday, we have a relatively light calendar, with no major events or indicators due to be released.

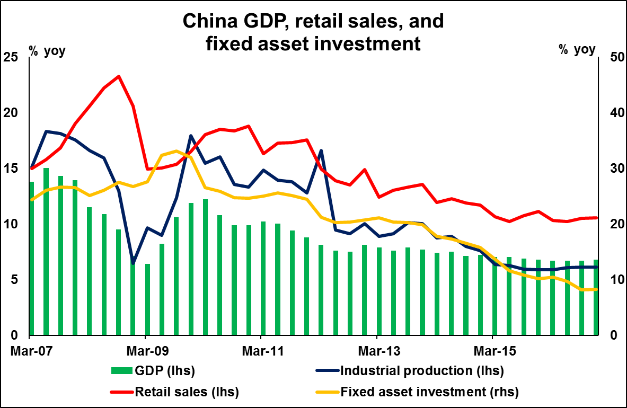

On Tuesday, during the Asian morning, we get China’s retail sales, industrial production and fixed asset investment data, for the months of January and February, as these indicators were not released last month due to the Chinese Lunar New Year holiday. The forecast is for industrial production and asset investment to have accelerated somewhat, while retail sales are expected to have slowed. We see the risks surrounding retail sales as skewed to the upside, perhaps for a smaller than expected slowdown, considering that the nation’s imports surged in January and then skyrocketed further in February. Such solid data could indicate that the Chinese economy continues to be stable. These are likely to be encouraging news for the PBoC. They may allow the Bank more room to tighten its policy further if needed in order to defend the yuan against an appreciating dollar due to a hawkish Fed.

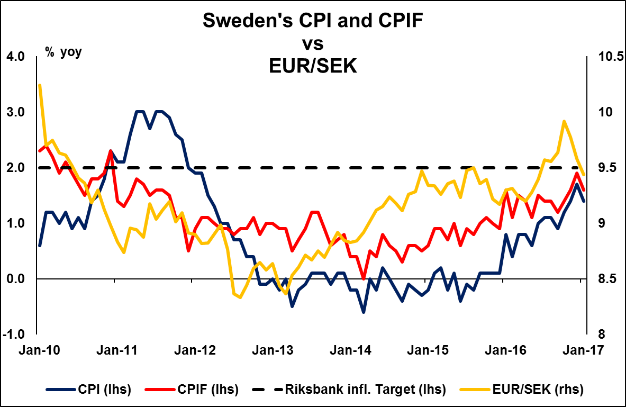

From Sweden, we get CPI data for February. The forecast is for both the headline and the underlying CPI rates to have risen. At its latest gathering, the Riksbank was surprisingly dovish in our view. Although the officials acknowledged the domestic economy is improving, they also indicated that rising political uncertainties abroad have increased the risks of setbacks. In addition, they noted that for inflation to stabilize around the 2% target, a slowdown in the krona’s appreciation is required and thus, monetary policy needs to remain expansionary. As a result, accelerating inflation is unlikely to lead to a material shift in the Riksbank’s dovish rhetoric in the months to come, given that upbeat policy signals could trigger a surge in SEK.

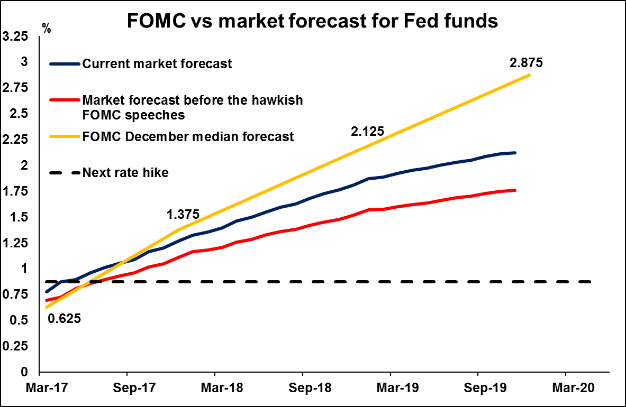

On Wednesday, the highlight will be the FOMC rate decision. This will be one of the “bigger” meetings that also includes updated forecasts on the US economy, projections on the rate path, as well as a press conference by Chair Yellen. The Committee is widely expected to hike borrowing costs, with the probability for such action currently resting at 90% according to the Fed funds futures. This percentage skyrocketed from 26% last week, following an unexpected string of hawkish comments from several Committee members, who noted that the case for a near-term rate hike is very strong.

This was surprising, at least for us, mainly because the underlying fundamentals of the US economy didn’t change following the February meeting, the minutes of which showed a cautious Committee. Economic data are short of spectacular, and uncertainty around the future of fiscal policy did not dissipate substantially following Trump’s speech to Congress. We considered these factors as providing ample reason for the Committee to remain patient, perhaps until the summer meetings. Nevertheless, it seems that policymakers want to take action now and we think this may be related primarily to global, and not domestic factors. The fact that global markets are calm at the moment allows the Fed to proceed without rocking the boat, something suggested by Fed Board Governor Brainard.

Considering that a hike is almost fully priced in, we don’t expect a major market reaction in case the Fed simply acts as expected. Investors are likely to quickly turn their attention to the updated “dot plot”, for fresh signals on the rate path. We expect the “dot plot” to remain unchanged and signal a total of 3 hikes in 2017, with risks skewed towards an upward revision. In her latest comments, Chair Yellen suggested that the process of scaling back accommodation in the future will probably not be as slow as it was in 2015 and 2016. We should also bear in mind that in December, only some FOMC members included expectations for greater fiscal policy in their forecasts. This suggests that when the outlook for fiscal policy becomes clearer, we could see the “dot plot” being revised higher, if not in March, then perhaps in June or September. Even if the “dot plot” is left unchanged, we expect Chair Yellen to maintain a confident tone overall, which could heighten market expectations for faster rate hikes in the future.

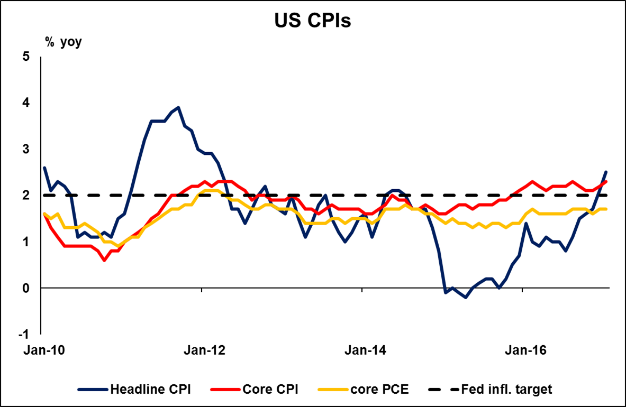

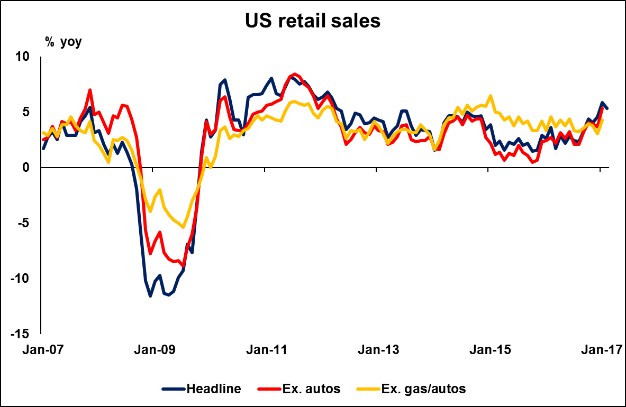

As for the US indicators, we get CPI and retail sales figures, all for February. No forecast is available for the CPI figures. We see the case for both the headline and core rates to have remained unchanged, with minor risks to the downside. The Prices sub-indices of the nation’s ISM manufacturing and non-manufacturing PMI surveys for February both ticked down, indicating that although prices continued to rise at a sharp pace, they rose somewhat slower than previously.

As for retail sales, both the headline and the core figures are expected to have slowed from the previous month. However, consumer confidence indices were mixed in February, with the Conference Board index rising but the U of M figure declining, something that does not paint a clear picture. In any case, considering that investors will probably have their gaze locked on the FOMC meeting later in the day, they may attract less attention than usual.

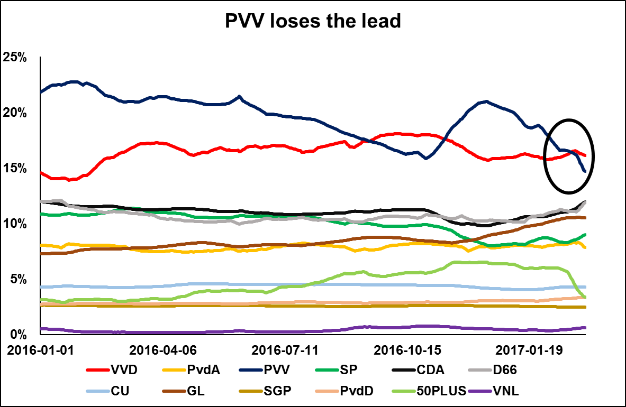

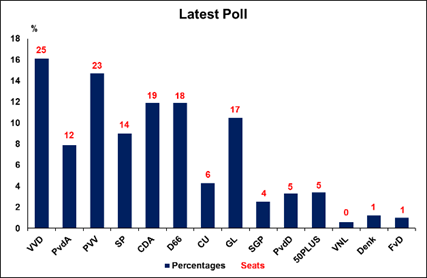

In terms of political events, market participants will keep an eye on the Dutch elections. This is mainly because one of the most popular candidates is Geert Wilders, the leader of the far-right Party for Freedom (PVV) and an outspoken Eurosceptic who wants to hold a “Brexit” style referendum for leaving the EU. Thus, the prospect of his election poses a threat to continued European integration, something that could impact market sentiment overall. Wilders was leading the polling battle since November, with the center-right People’s Party for Freedom and Democracy (VVD), the party of the current PM Mark Rutte, holding the second place. However, recent polls suggest that VVD has taken the lead, and the gap appears to be widening as we head into the ballots.

What’s more, according to the latest poll, no single party is even close to reaching the 76 seats needed to form a government. This suggests that even in case PVV gets the first place in this election, Wilders would still need the support of several other parties to become the next PM, which is unlikely because most of them have pledged not to work with him. No other party supports his political vision for holding a referendum on leaving the EU. This is another factor making the whole “Nexit” story seem highly unlikely.

Now in terms of market reaction, in case PVV and Wilders do not manage to gain the first place in the election, the euro is likely to experience a relief bounce as the first political threat to the EU this year will be out of the way. Nonetheless, we don’t expect such a rebound to evolve into a strong bullish run, as the next risk event, the French election, will be just around the corner. On the other hand, if Wilders is crowned as the winner, even if he does not manage to establish a government, his strong showing could add momentum to the campaign of the French far-right candidate, Marine Le Pen. Thus, a PVV victory may cause the euro to give back some of the gains it posted following the recent ECB meeting, and in combination with a rate hike by the Fed, it could push EUR/USD lower much faster than otherwise.

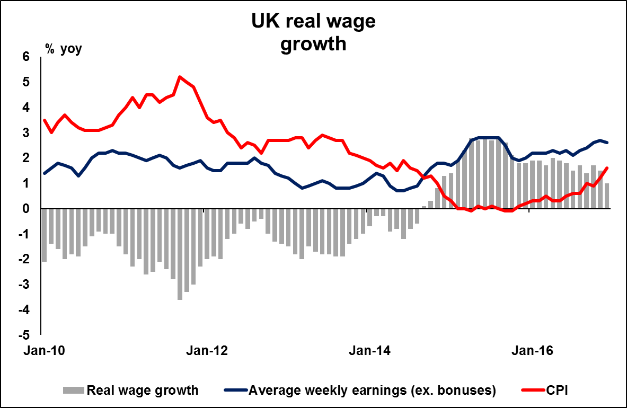

From the UK, we get the employment report for January. The forecast is for the unemployment rate to have remained unchanged, while average weekly earnings are expected to have slowed. The unemployment rate forecast is supported by the nation’s services PMI for the month, which indicated that employment continued to rise, although the rate of job creation slowed notably. The survey also showed that firms had to cope with rising cost pressures for fuel, imports and salaries, which in our view suggests that we may see an unchanged earnings rate as well, instead of a decline.

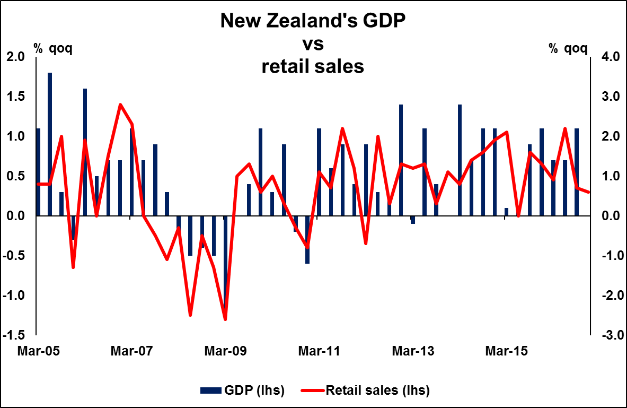

Later during the day, New Zealand’s GDP data for Q4 are due to be released. The nation’s economic indicators remained decent throughout the quarter. Although retail sales slowed somewhat further, exports accelerated and imports slowed somewhat, suggesting that the nation’s trade deficit may have narrowed somewhat, an optimistic sign for economic growth. Bearing these in mind, we see the case for New Zealand’s GDP to have risen at the same rate as previously, with retail sales posing some downside risks.

On Thursday, we have an extremely busy day, with 4 central bank meetings on the agenda: the Bank of Japan, the Swiss National Bank, the Norges Bank and the Bank of England.

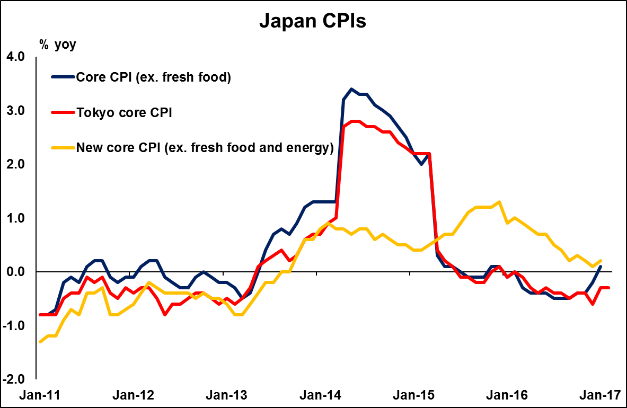

Let’s kick off with the BoJ, which will announce its policy decision during the Asian morning. The Bank is expected to keep its policy unchanged. At its latest gathering, the BoJ raised its GDP growth forecasts for the next years, and its overall tone with regards to the domestic economy was slightly more optimistic than previously. Since that meeting, economic developments have been mixed. GDP growth remained in positive territory for another quarter in Q4 and the core CPI rate for February gained a positive sign for the first time since December 2015. However, the more forward-looking Tokyo core CPI rate for March remained unchanged below zero, indicating that underlying inflationary pressures have not really begun to pick up. Even though such prints are unlikely to be very reassuring for BoJ policymakers, they are decent enough to not warrant any action, in our view. This is supported by recent comments from Governor Kuroda, who indicated in late February that the chance of any more rate cuts is small for now. Thus, we believe that the focus of this meeting will be on the Bank’s assessment regarding the Japanese economy and any signals on the future path of policy. Considering the mixed data lately, we expect the BoJ to maintain a neutral to dovish tone, providing no indications that its ultra-loose policy framework may be altered anytime soon.

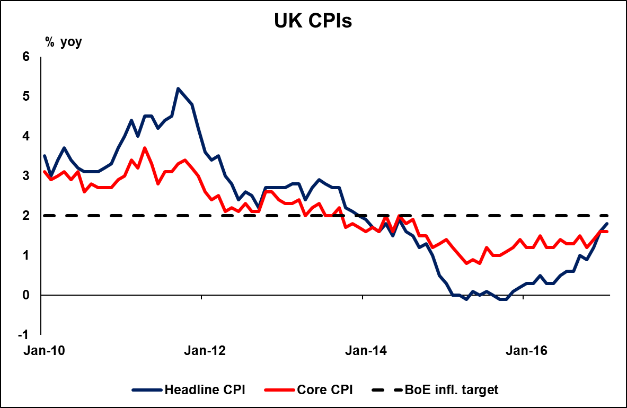

In the UK, GBP-traders will have their gaze locked on the BoE policy decision. Expectations are for the MPC to keep policy untouched via a unanimous vote and thus, we expect market attention to quickly turn to the meeting minutes. The minutes from the latest gathering revealed that although some policymakers have moved a little closer to their limits of tolerating above-target inflation, the overall consensus was that the MPC remains willing to “look though” such an overshoot. Since that gathering, inflation data showed that the headline CPI accelerated in January and got closer to the Bank’s 2% target, but the core CPI rate remained unchanged at +1.6% yoy. We believe that investors will look once again for hints with regards to the officials’ outlook for inflation, but we don’t expect them to find any material changes compared to the previous minutes. As other central banks of developed nations have done recently, the BoE is also possible to attribute the improvement in headline inflation to temporary effects, such as rising energy prices. Looking ahead, we don’t expect the Bank to start considering raising interest rates any time soon. Kristin Forbes, a policymaker who has consistently called for an increase, will leave the Committee in June. So after the summer, the member who is most likely to lean towards such an action is the notorious hawk Ian McCafferty. Nevertheless, at the latest BoE testimony, he signaled that there is “some hope” that interest rates could start to normalize in two or three years. Even though that depends on how inflation evolves over the coming months, McCafferty’s remarks show that there is very little appetite for rate hikes within the Committee.

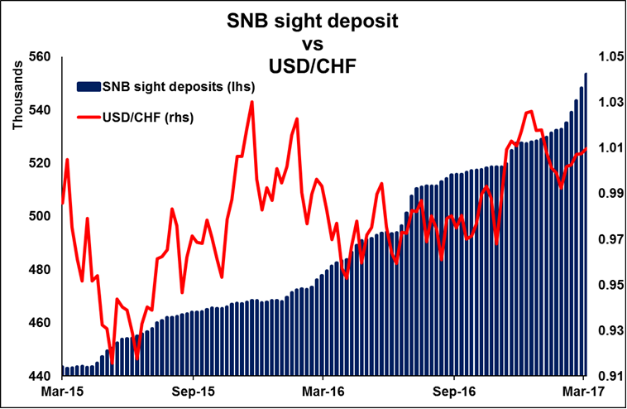

Turning to the SNB, we expect this Bank to remain on hold as well, amid an improving economic outlook. Even though GDP growth was lackluster in Q4, inflationary pressures have been intensifying in Switzerland. The nation’s CPI rate has been on a steady uptrend since late 2015, and in February it rose further to reach +0.6% yoy, a level last seen in 2011. Although this will probably be a pleasant development for the SNB, we doubt that it will be enough to lead to a material shift in the Bank’s dovish rhetoric. As such, the meeting statement may be slightly more upbeat to reflect the progress in inflation, but we still expect the Bank to reiterate that the Swiss franc remains significantly overvalued. Although USD/CHF has moved higher in recent months, partly due to the dollar’s appreciation following the US election, EUR/CHF has continued along its downtrend. Thus, the SNB is likely to reiterate its previous mantra that it is still willing to intervene in the FX market to curb CHF gains.

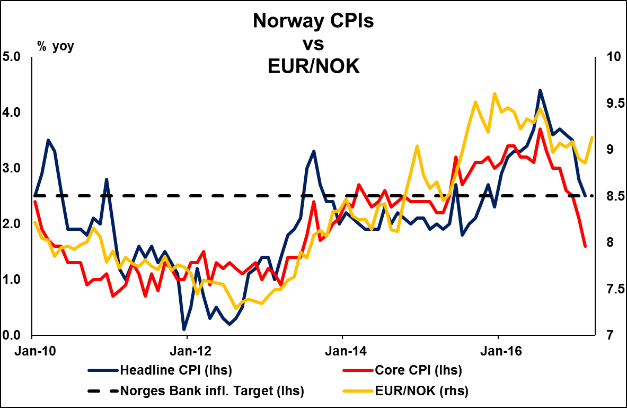

Now let’s carry on with the Norges Bank. When they last met, in December, policymakers did not take any policy action, and maintained a neutral tone in the statement accompanying the decision. They noted that there are prospects for inflation to be lower than projected and that changes in the outlook for inflation, if seen in isolation, imply a somewhat lower key policy rate for the months to come. However, they balanced that sentence by saying that a lower key policy rate increases financial stability risks. What’s more, Governor Olsen noted that the key policy rate will most likely remain unchanged in the period ahead. Since then, data showed that both headline and core inflation have slowed significantly. However, mainland GDP accelerated in Q4, indicating progress in the economy even without taking into account the rise in oil prices during the quarter. All these suggest to us that although the Bank’s bias may shift to dovish in order to reflect the slowdown in inflation, the aforementioned stability risks are likely to keep the officials’ fingers off the easing trigger, at least for now.

On Friday, we have no major events or indicators on the economic agenda.