Daily Commentary | 27/03/2017

USD slips as Trump fails to reform health care

The US dollar opened with a negative gap against its major counterparts today, after the House vote regarding Trump’s healthcare bill was canceled on Friday. The Republican leaders decided to withdraw the bill altogether rather than suffer a defeat in the voting process, as they lacked the necessary votes to pass it. Even though President Trump and the Republican leadership quickly reassured investors that they will now concentrate on introducing big tax cuts, the inability of the new administration to deliver on health care may have raised concerns that tax reform is likely to encounter similar obstacles. What’s more, reforming health care was one of the conditions for making the tax numbers Trump pledged feasible. As such, heightened doubts over Trump’s ability to deliver on his tax promises could keep sentiment among investors somewhat subdued and thereby, weigh further on the greenback. Asian and European equity indices felt the heat as well, opening with bearish gaps. This negative sentiment may roll over into the US markets, where we expect stock indices to open in a similar fashion.

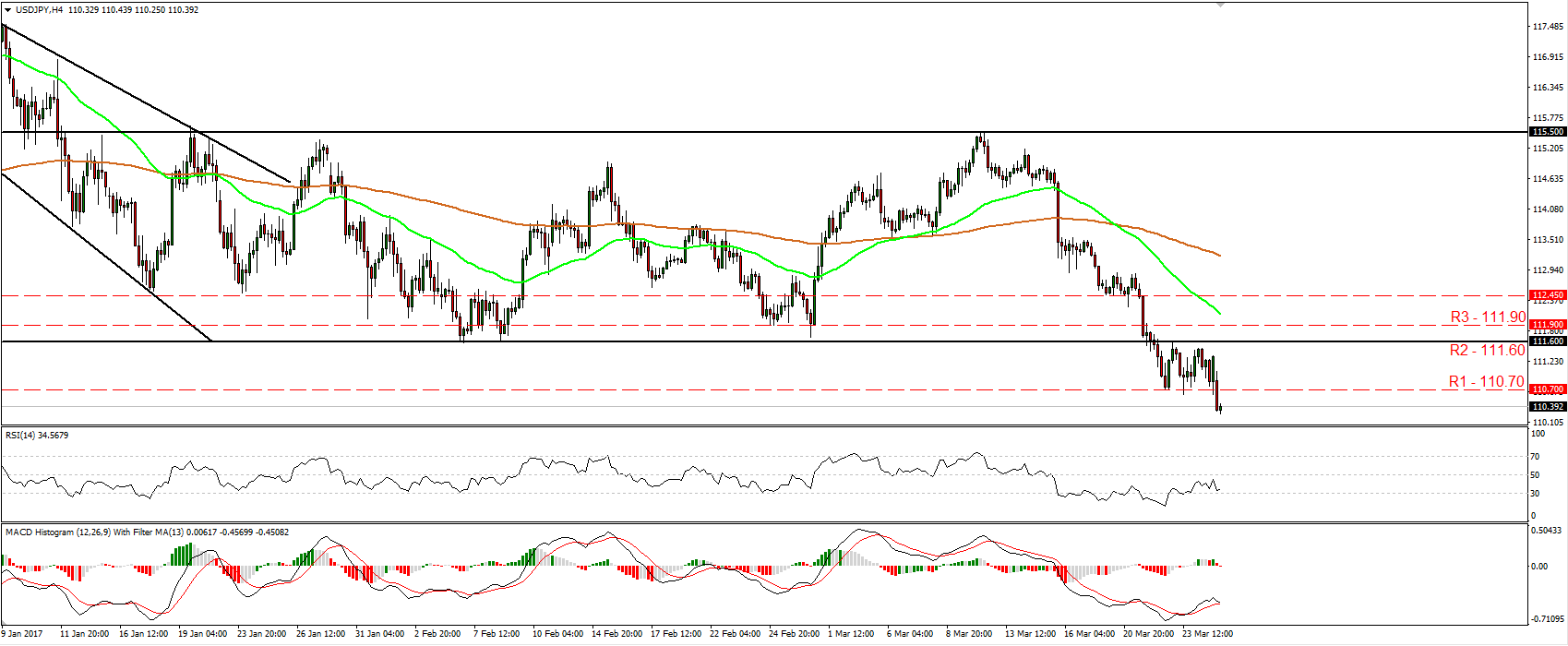

USD/JPY gapped down and continued to drift lower during the Asian morning Monday, falling below the support (now turned into resistance) barrier of 110.70 (R1). Following the dip below 111.60 (R2), the lower bound of the sideways range that contained the price action from the 11th of January until last Wednesday, we believe that the outlook has turned negative. Therefore, we expect the pair to continue trading south and perhaps challenge the round figure of 110.00 (S1) sometime soon. If the bears prove strong enough to overcome that psychological zone, then we may experience extensions towards our next support obstacle of 108.80 (S2), defined by the low of the 17th of November.

Eurozone’s PMIs surge and lift the euro Eurozone’s economic growth hit a six-year high in March, according to the bloc’s preliminary composite PMI survey that was released on Friday. The index beat its forecast for a marginal decline and instead rose further. The survey was upbeat on all economic fronts, indicating the best employment growth for almost a decade and perhaps even more importantly for ECB policymakers, that selling prices during the first quarter of 2017 rose at the steepest rates since 2011. The euro started strengthening ahead of the report, boosted by the German and French indices released a few minutes earlier, and continued drifting north in the aftermath of the bloc’s prints. Considering the strength of these forward-looking data, we could see the common currency enjoy increased demand in the next days or weeks on speculation that the ECB could start to reduce its stimulus dose perhaps as early as next year. In our view, if incoming data continue to show mounting inflationary pressures combined with robust economic growth, then the ECB may begin to sound gradually more hawkish at its upcoming meetings, thereby preparing market participants for an eventual tightening. However, something like that is conditional upon the bloc’s core CPI rate establishing an uptrend in coming months, as President Draghi made it clear that the Bank is unlikely to change its stimulus program without notable progress in underlying inflationary pressures.

EUR/USD opened with a positive gap on Monday, after the defeat of President Trump’s healthcare package on Friday. After clearing the 1.0800 (S2) key resistance (now turned into support) territory, the pair broke above the 1.0825 (S1) barrier and during the early European morning Monday, it looks ready to challenge the longer-term downtrend line taken from the peak of the 3rd of May and the resistance hurdle of 1.0875 (R1), marked by the high of the 8th of December. A decisive break above that key crossroad could solidify the completion of an inverted head and shoulders, signaled upon the breach of the 1.0800 (S2) territory, and is possible to confirm a medium-term trend reversal.

Today’s highlights: During the European day, we get Germany’s Ifo survey for March. The forecast is for the expectations index to have risen somewhat, while the current conditions figure is expected to have ticked down. We see the risks surrounding the current conditions forecast as skewed to the upside, perhaps for an increase instead of a marginal fall. We base our view on the ZEW and PMI surveys for the month, both of which showed increased optimism in the German economy. In case of a positive surprise, the euro could extend its recent gains, as this would be another set of numbers entering the basket of data that support a gradual end to the ECB’s stimulus program.

As for the rest of the week, on Tuesday, the economic calendar is light. The only event that is likely to attract some market attention is a speech by Fed Chair Yellen.

On Wednesday, the main event will be in the UK, where PM May is expected to trigger Article 50 of the Lisbon Treaty and commence the formal process for leaving the EU. We do not expect the actual triggering to be a particularly big market mover for sterling, as the move and timing have been signaled repeatedly over the past months and weeks.

On Thursday, we get Germany’s preliminary CPI figures for March and from the US, the final estimate of Q4 GDP.

On Friday, during the Asian morning, Japan’s CPI data for February are due to be released. In Eurozone, preliminary CPI data for March are coming out and in the UK, the final estimate of Q4 GDP will be in focus. From the US, we get personal income and spending data for February, as well as the core PCE price index for February.

USD/JPY

• Support: 110.00 (S1), 108.80 (S2), 107.70 (S3)

• Resistance: 110.70 (R1), 111.60 (R2), 111.90 (R3)

EUR/USD

• Support: 1.0825 (S1), 1.0800 (S2), 1.0760 (S3)

• Resistance: 1.0875 (R1), 1.0920 (R2), 1.0950 (R3)