Next week’s market movers

• In the UK, Parliament will vote on the Queen’s Speech, which will determine whether May will keep her position as PM or not.

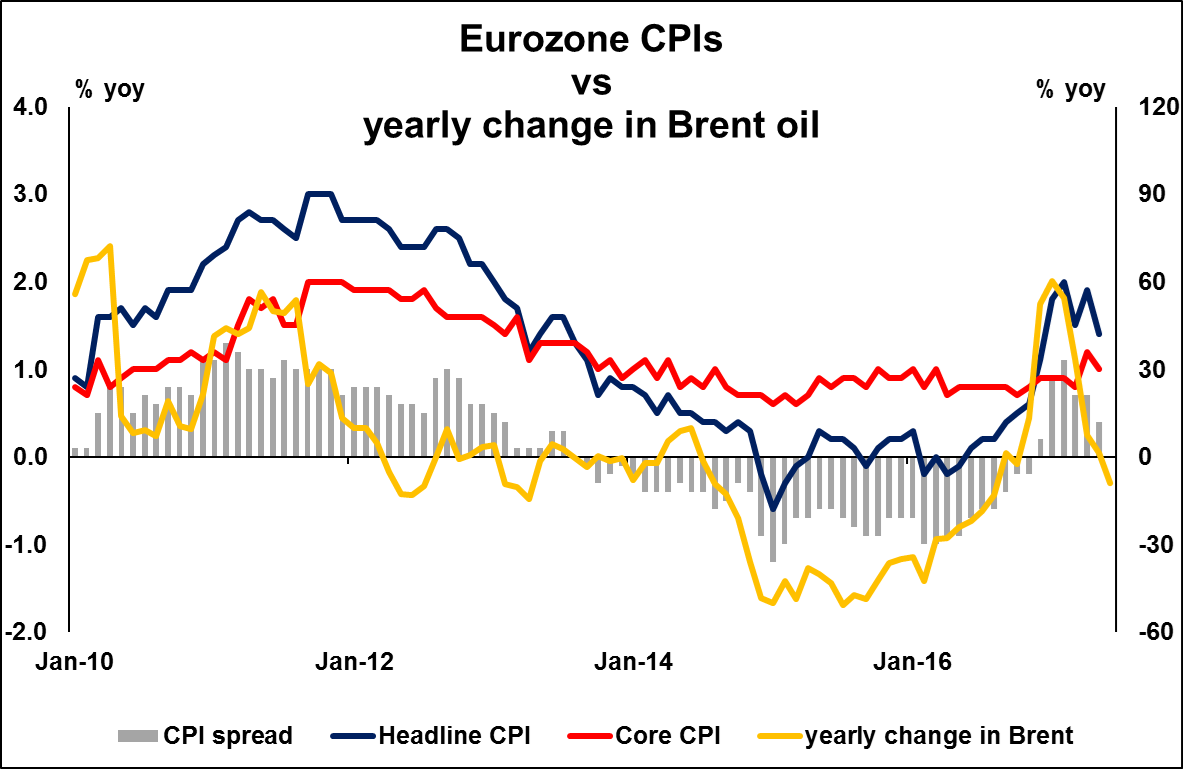

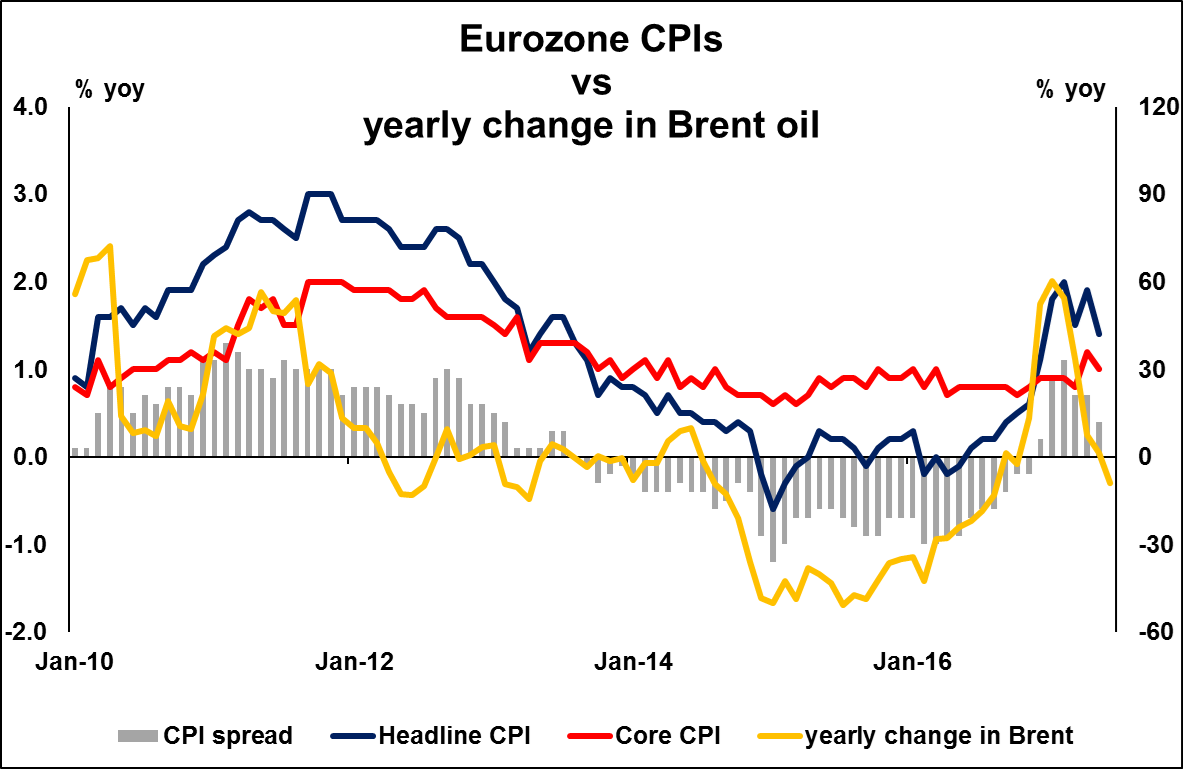

• In Eurozone, preliminary CPI data for June could provide some guidance as to whether the ECB is likely to continue shifting towards a more upbeat bias.

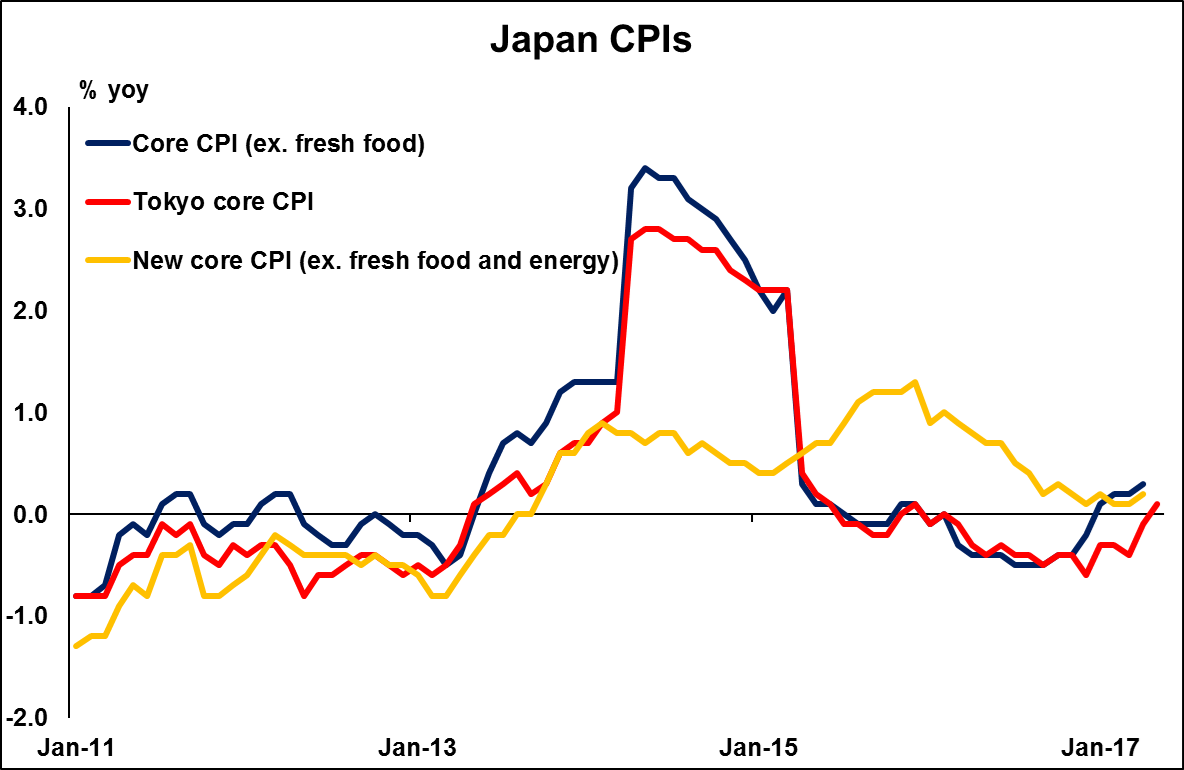

• Japan’s inflation data for May are expected to show further acceleration in prices. Even though this progress is likely to be encouraging for the BoJ, policymakers are still a long way off from declaring victory.

• We also get key economic releases from Germany, the US, the UK, and China.

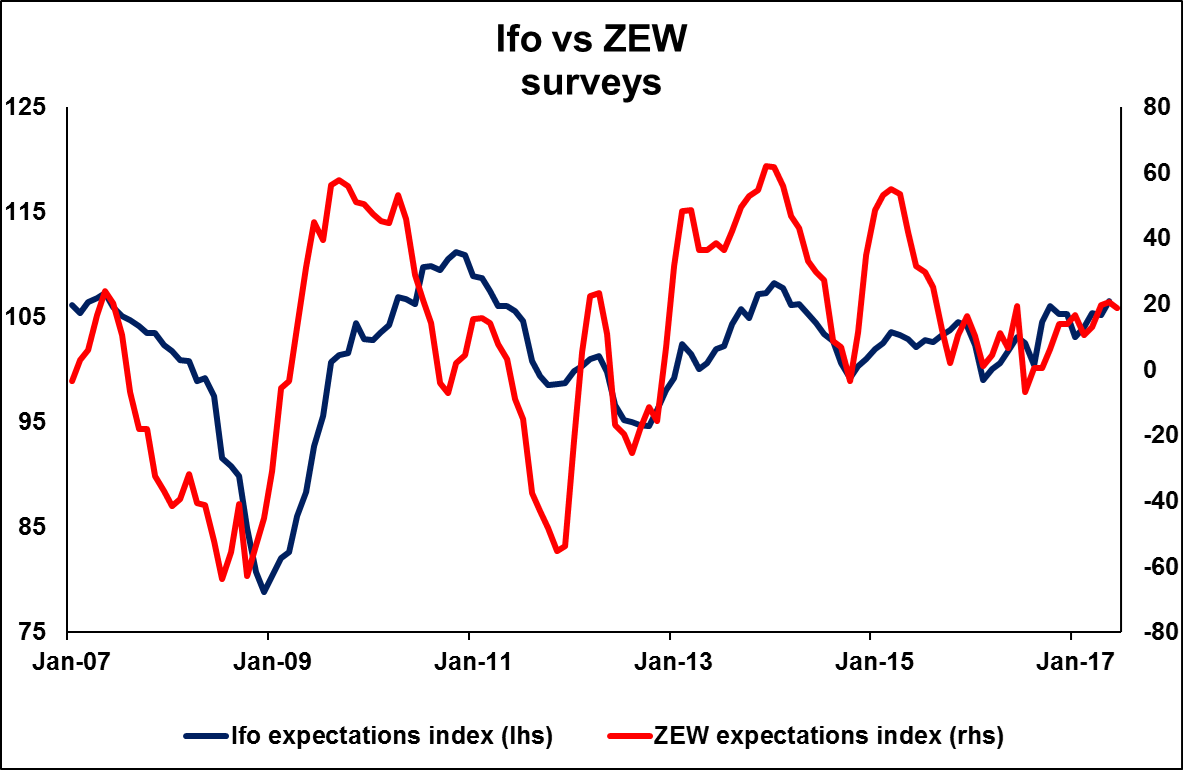

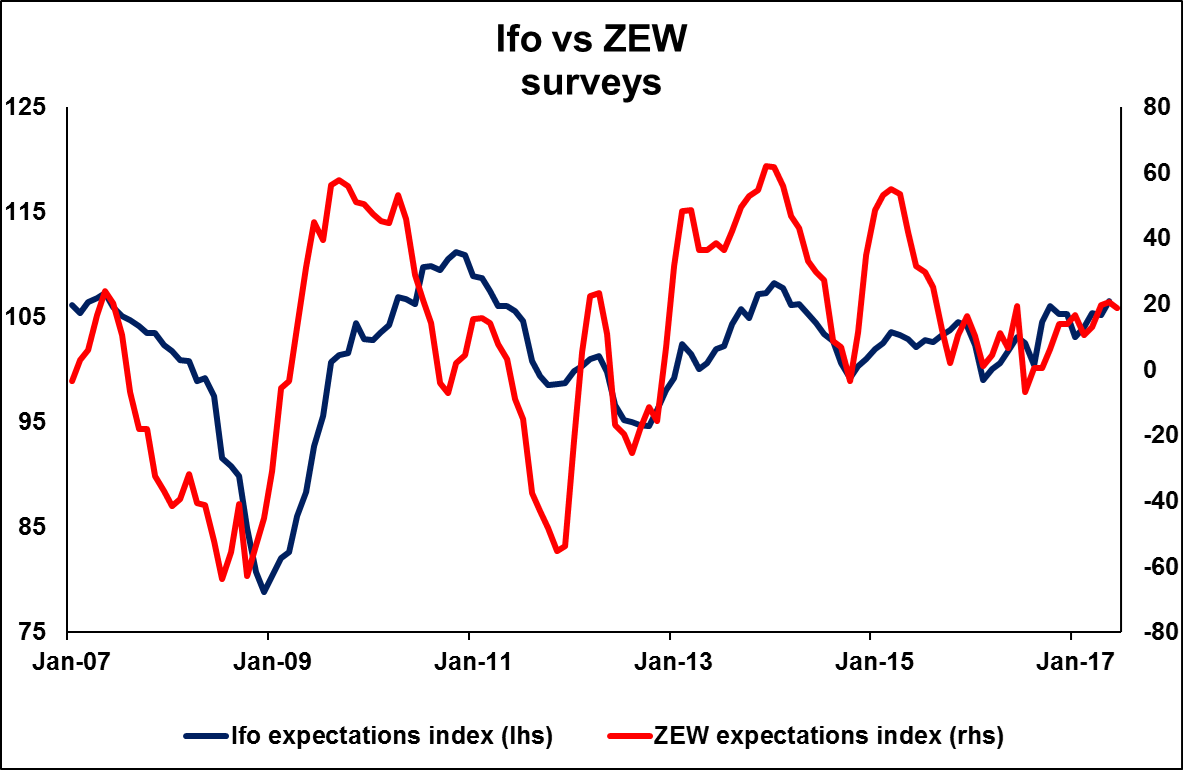

On Monday, we get Germany’s Ifo survey for June. Expectations are for an uptick in the current conditions index and a downtick in the expectations figure, something supported by similar movements in the month’s ZEW indices. Nonetheless, even if the expectations index comes down slightly, we don’t expect that to be worrisome for ECB policymakers, considering that the survey would still point to heightened optimism among German businesses. Indeed, the composite Ifo index reached a fresh all-time high in May, so any minor pullback will probably be seen as normal by both policymakers and investors.

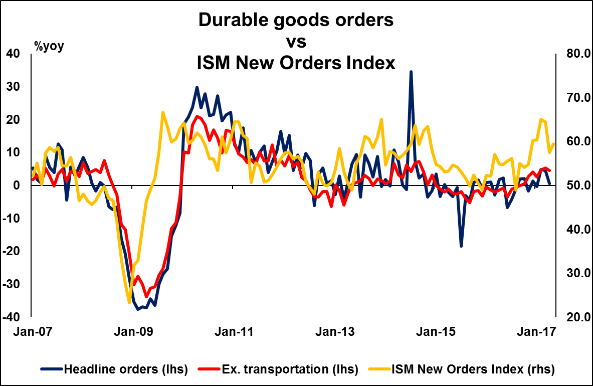

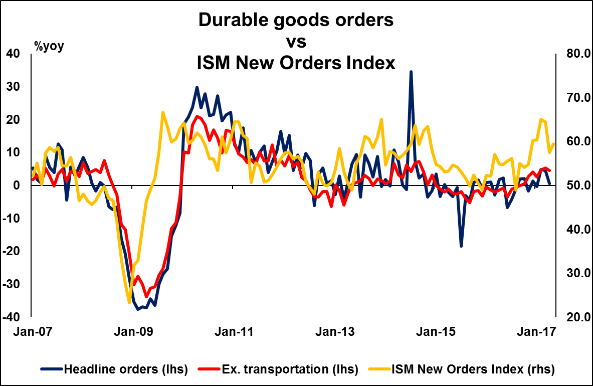

In the US, durable goods orders for May are coming out. The forecast is for headline orders to have fallen again, but at a slower pace than previously, while the core rate that excludes transportation equipment is expected to have turned positive. Such prints would drive both the yearly rates up, something that is also supported by the nation’s ISM manufacturing PMI, which showed that new orders rebounded during the month.

On Tuesday and Wednesday, the economic calendar is very light, with no major events or indicators due to be released.

On Thursday, the UK Parliament is expected to vote on the Queen’s Speech after six days of debate. Although the Speech contained little on the Brexit front and passed relatively unnoticed by the financial world on the day, we believe that the actual vote will keep investors on the edge of their seats, as it will determine whether May keeps her position as the UK PM. Importantly, at the time of writing, the agreement between the Tories and the DUP has not been finalized yet. This implies that it is not certain yet Theresa May will get the Speech passed and stay on as PM. If May manages to establish a government, we could see some political uncertainty dissipating, which could lead to a relief rally in sterling. On the other hand, if May is unable to get the Queen’s speech passed, then Labour leader Jeremy Corbyn would be invited to attempt to form a government. In this scenario, GBP could trade lower initially on the possibility of prolonged uncertainty over the timeline of the EU-UK talks. However, we think that the prospect of a Labour government or another election could result in a stronger pound overall, as the likelihood of a hard Brexit will probably diminish.

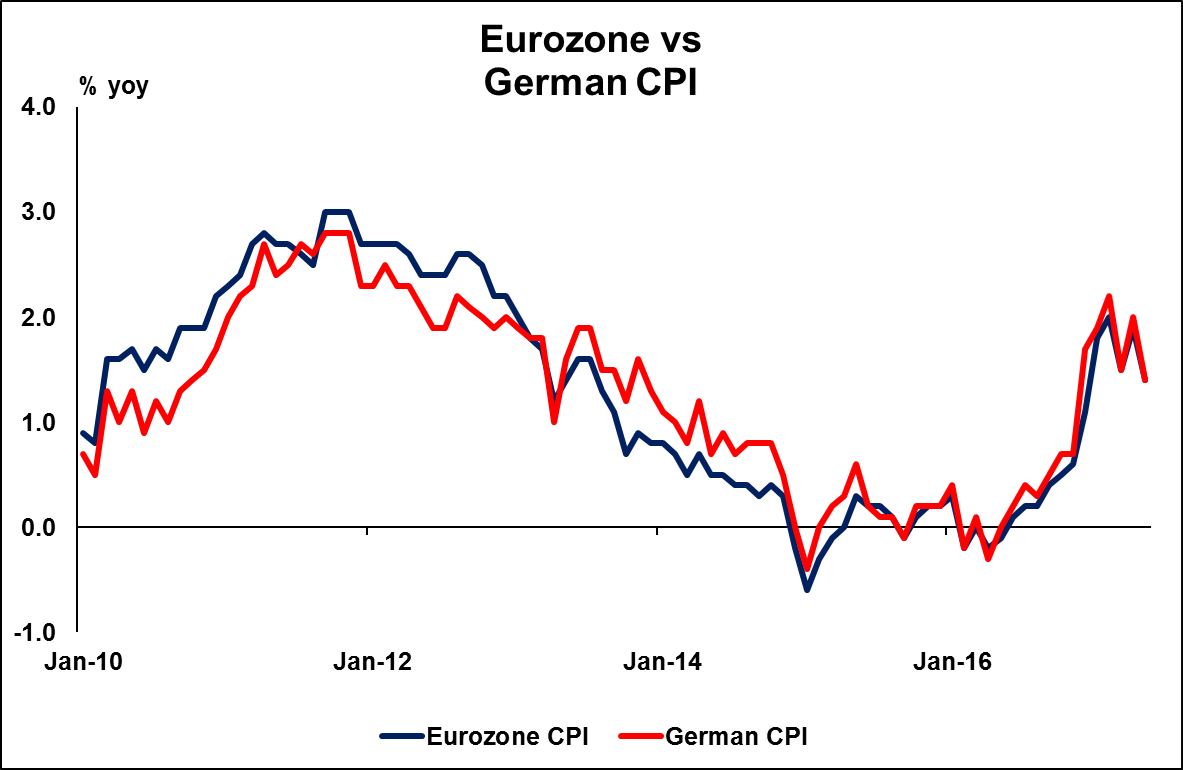

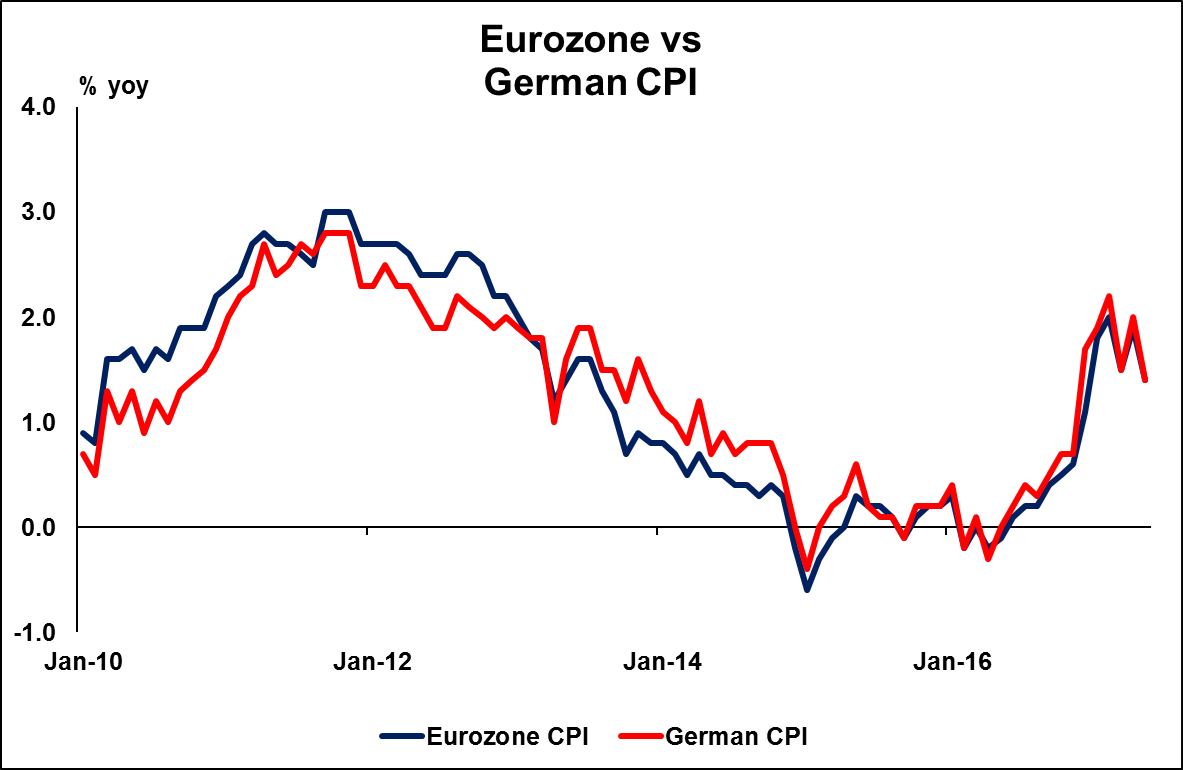

As for the economic indicators, we get Germany’s preliminary CPI data for June, one day ahead of Eurozone’s. The forecast is for the nation’s inflation rate to have fallen again, something supported by the preliminary composite PMI for the month, which showed prices charged by firms rose at the weakest rate in seven months. Even though such a decline could be seen as a somewhat discouraging development for ECB policymakers, we would like to stress that Germany reports only a headline, not a core, inflation rate. This implies that a small slide in this rate could be owed mainly to movements in the prices of volatile items, and may not necessarily be descriptive of underlying inflationary pressures in Eurozone’s economic powerhouse.

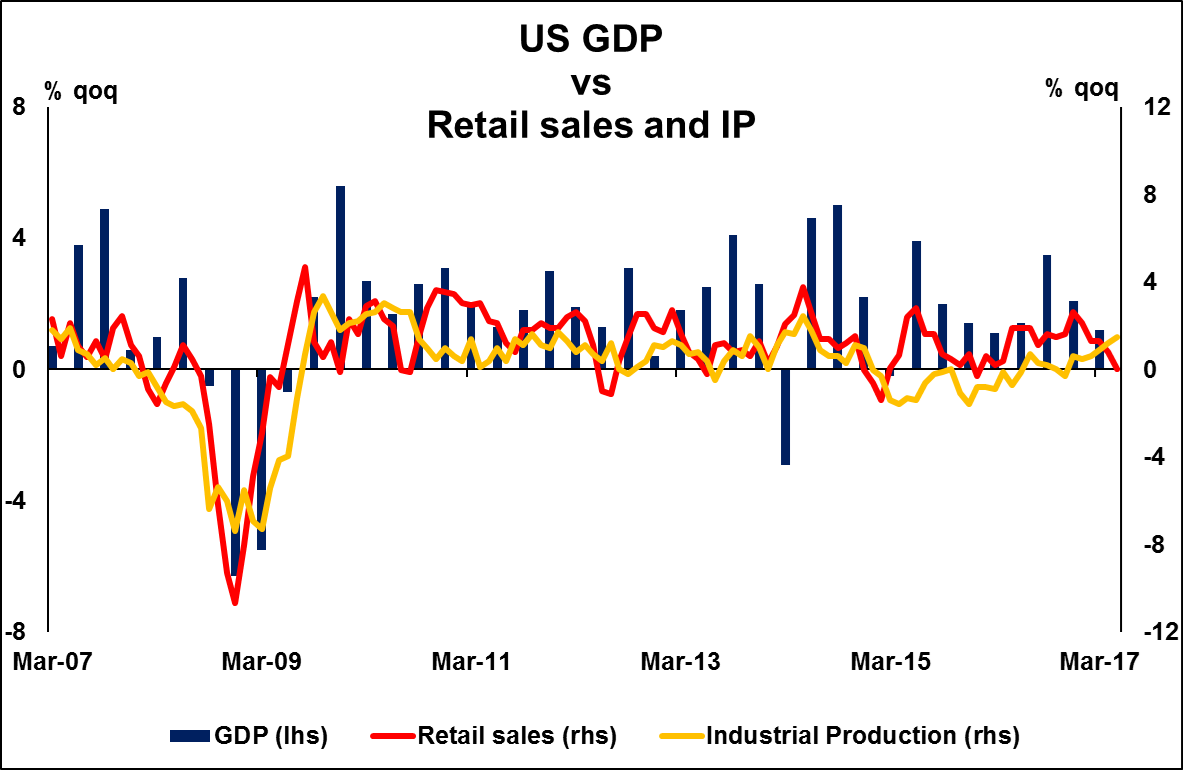

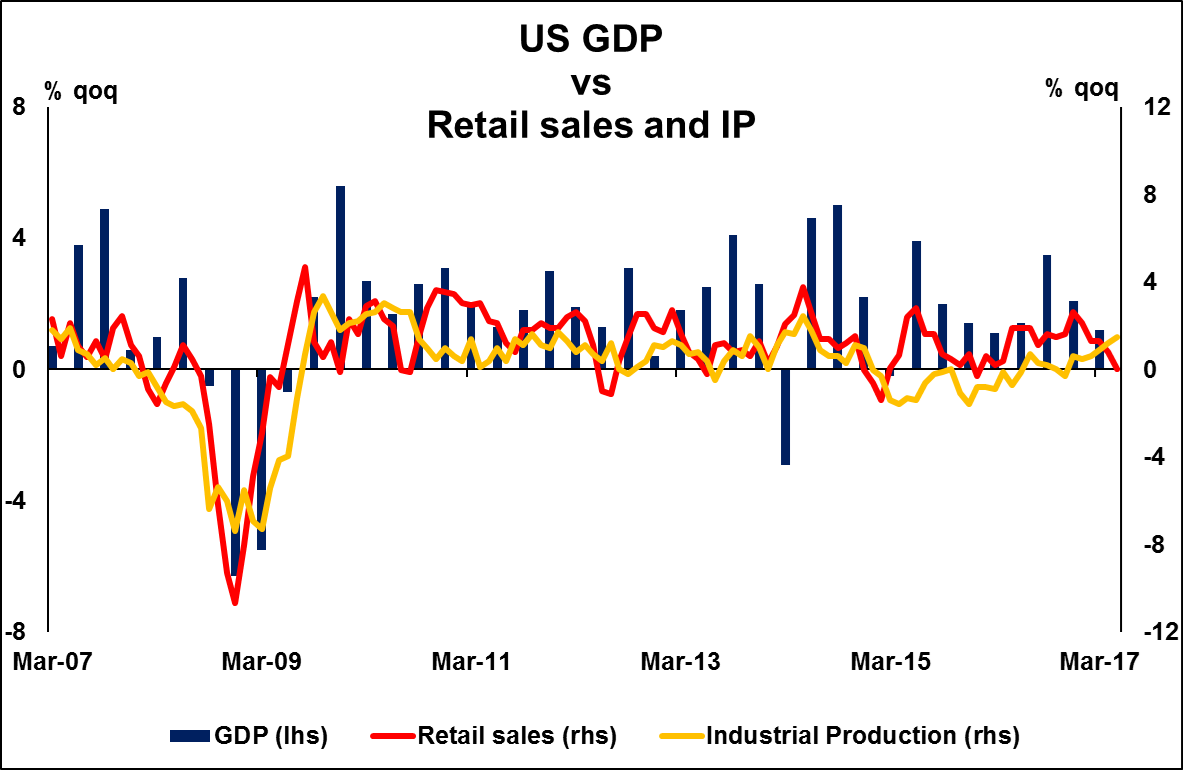

From the US, we get the final estimate of GDP for Q1 and expectations are for the final print to confirm the second estimate. That said, considering that Q2 is almost over, we think that these data are likely to be viewed as outdated. In addition, the Fed has already noted in its latest policy meetings that it views the slowdown in Q1 as transitory, so no revision in GDP is unlikely to raise any eyebrows.

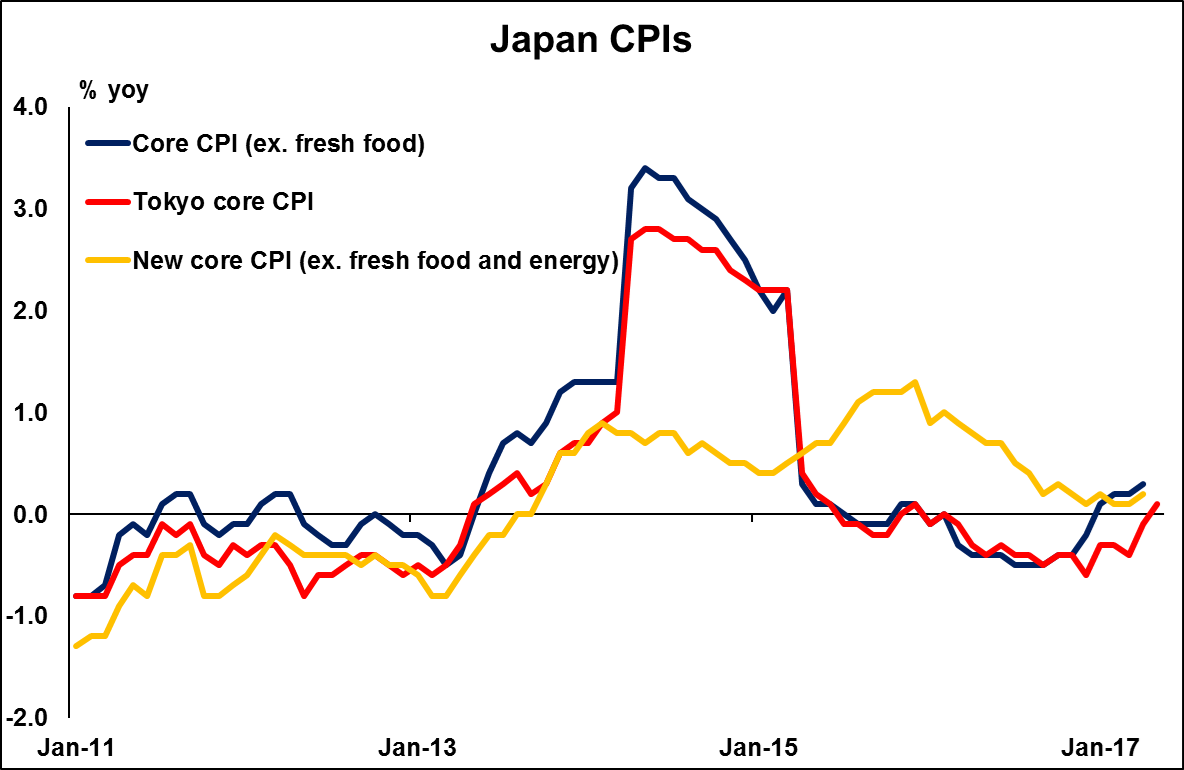

Finally on Friday, during the Asian morning, we get Japan’s CPI data for May. The core rate is expected to have ticked up again, while no forecast is available for the headline figure. We share the view for another increase in the core rate, and we see the case for an uptick in the headline rate too. We base this on the nation’s forward-looking Tokyo CPI rates, both of which rose by more than expected in May. Even though these signs of progress are encouraging, as they could be indications that inflationary pressures are finally picking up some steam in Japan, we have to note that both rates are still close to 0%. As such, we maintain our view that even if the CPI rates move a little higher, as long as they remain far below the BoJ’s target of 2%, the Bank is unlikely to alter its current framework of QQE with yield-curve control.

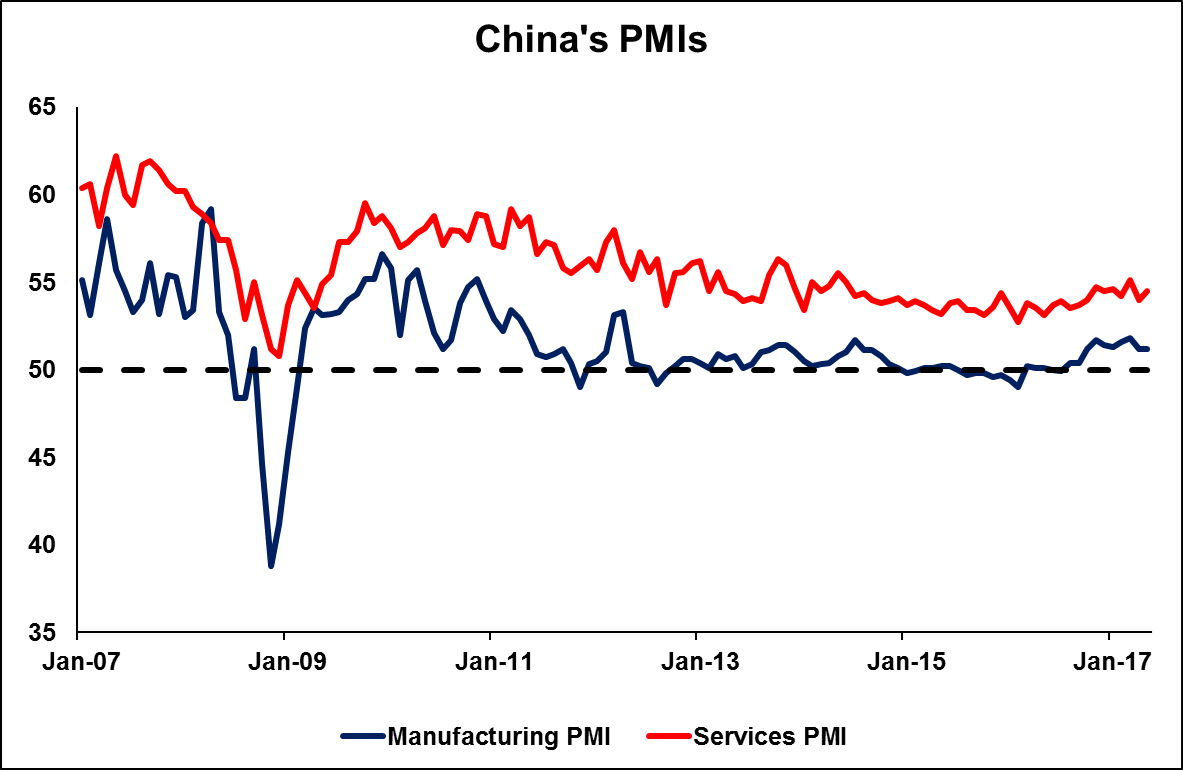

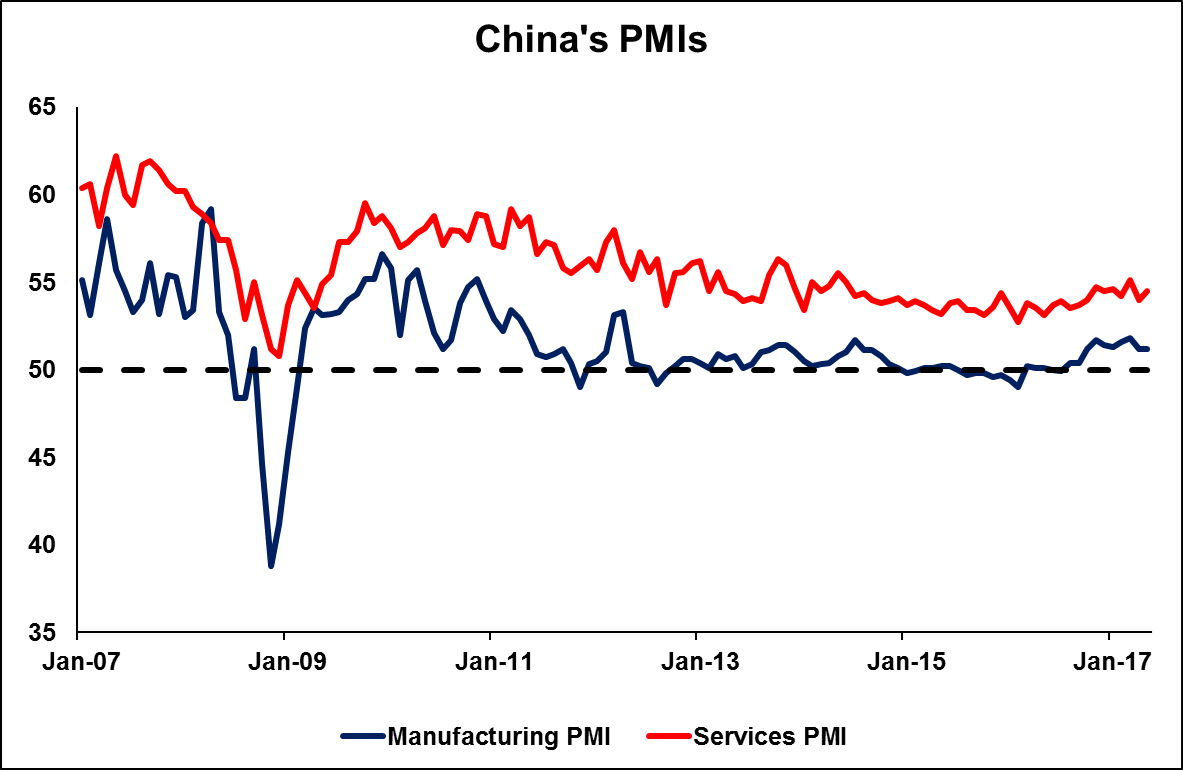

From China, we get the official manufacturing and non-manufacturing PMIs for June. Expectations are for the manufacturing index to have declined, but to have remained modestly above the 50 mark, while no forecast is available for the non-manufacturing one. We think that the focus may be primarily on the manufacturing figure, following the tumble in the respective Caixin index for May, which took markets by surprise by entering the contractionary territory for the first time in almost a year. This generated concerns that the Chinese economy may have resumed its prior slowdown. As such, a potential downtick in the official index for June could add some credibility to such concerns.

In Eurozone, preliminary CPI data for June are due out. The forecast is for the headline rate to have declined, but for the core rate to have held steady. Considering that the ECB has repeatedly indicated it is “looking through” changes in the headline print, we don’t think a decline in this rate will be worrisome for policymakers, conditional upon the core staying unchanged. In this case, we don’t expect these data to have much impact on the ECB’s future decisions, and we maintain our view that the Bank is likely to continue to shift towards a more sanguine bias at its upcoming meetings. Having said that, in case the core CPI unexpectedly slows, this may be seen as a disappointment and could scale back expectations with regards to further shift in language by the ECB in coming months.

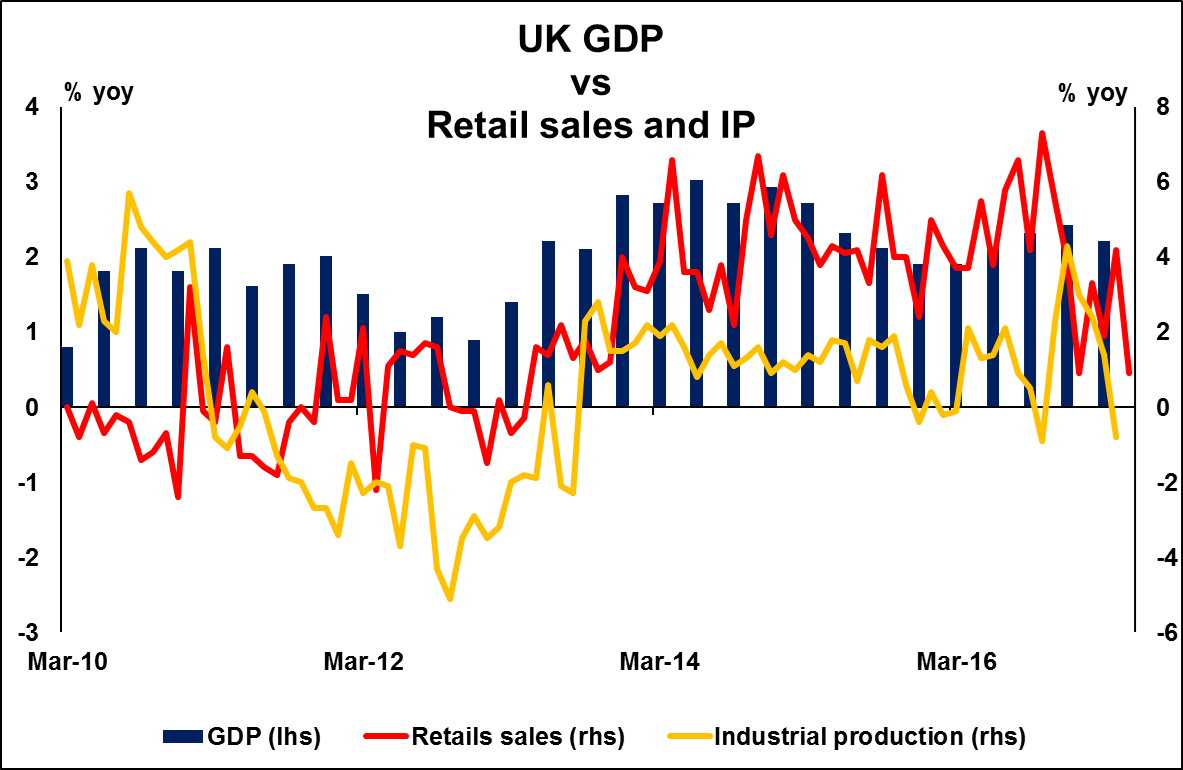

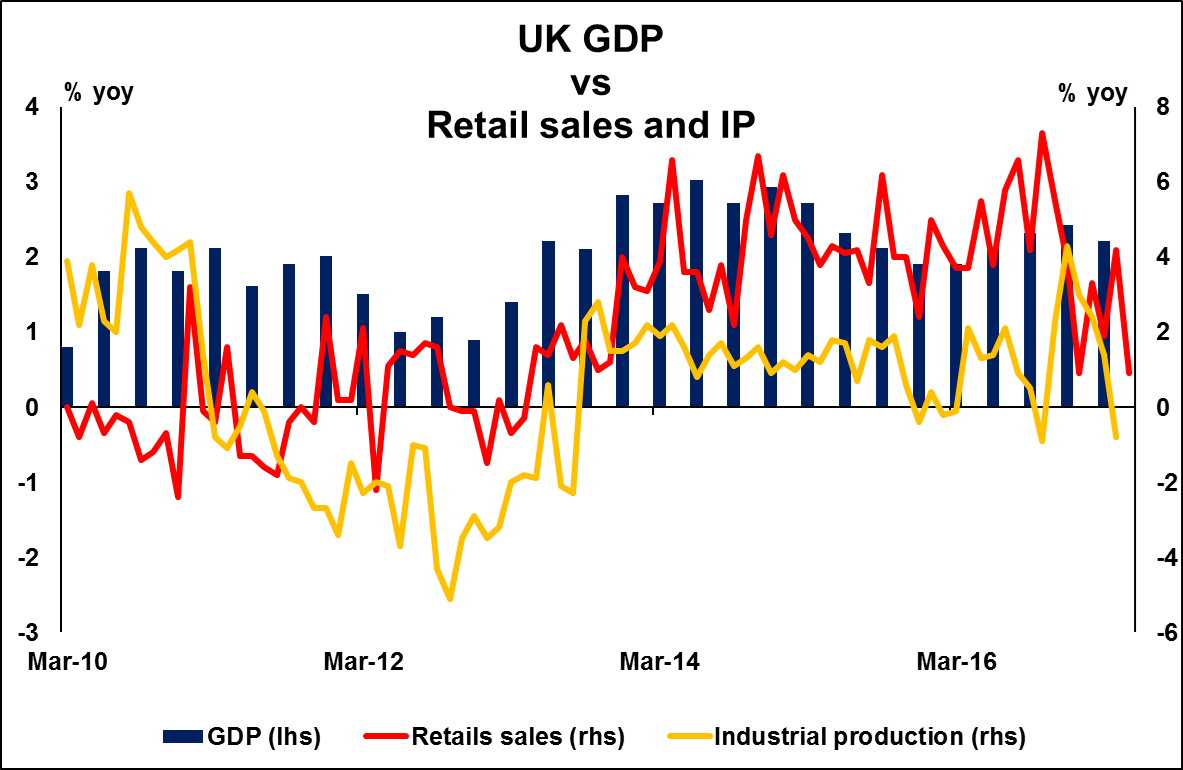

From the UK, we get the final estimate of GDP for Q1, though no forecast is available yet. In the 2nd estimate, economic growth was revised down to +0.2% qoq from +0.3% qoq. Even though the final figure is usually not a major market mover, we think it is likely to attract some market attention this time, considering that in its latest meeting minutes, the BoE anticipated the final print to be revised back up to +0.3% qoq. If indeed this is the case, it may add some further fuel to speculation regarding a potential BoE rate hike by the end of the year. That said, we stick to our view that the biggest determinant of whether the Bank will raise rates may be wage and inflation data. We believe that a material pickup in domestic inflationary pressures, particularly in wages, is needed for the Bank to act.

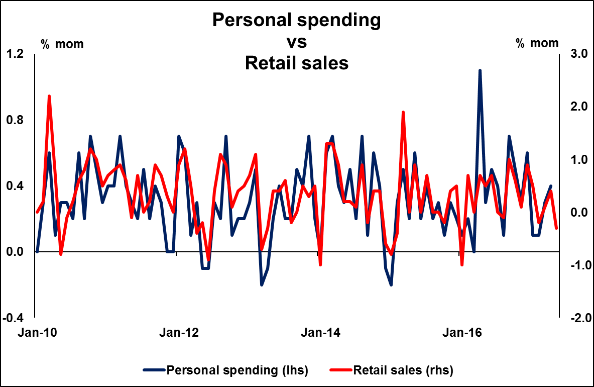

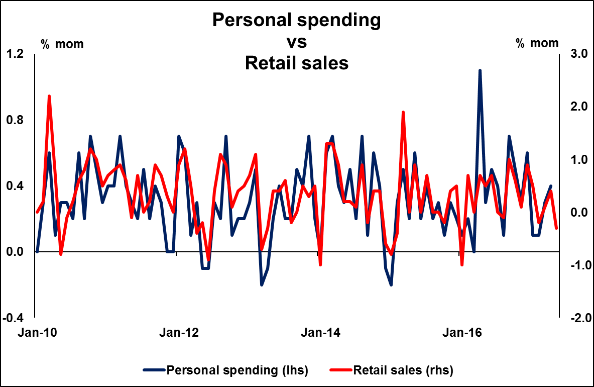

From the US, we get personal income and spending data for May. Expectations are for both the income and spending rates to have slid somewhat. We see the possibility for an unchanged print in personal income given that the average hourly earnings rate stayed unchanged in May, both in monthly and yearly terms. As for the spending forecast, given the slide in retail sales for the month, a slowdown appears more than normal to us. We wouldn’t rule out even a negative print.

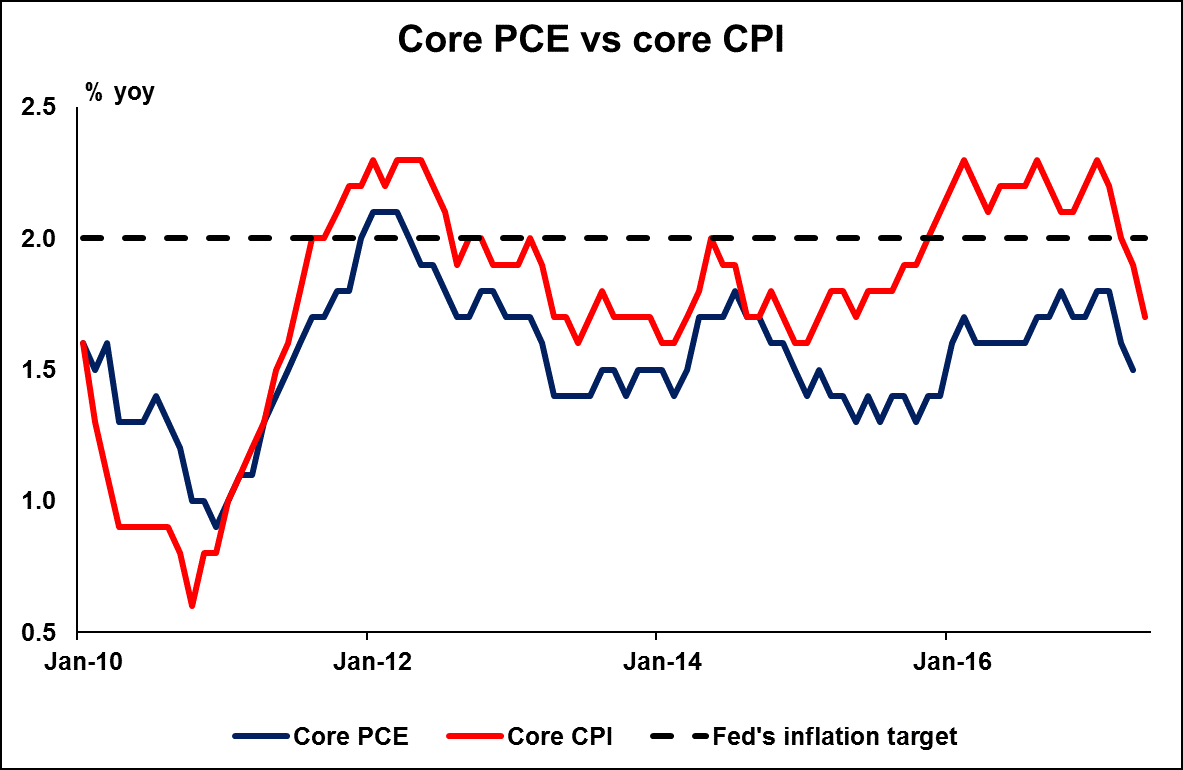

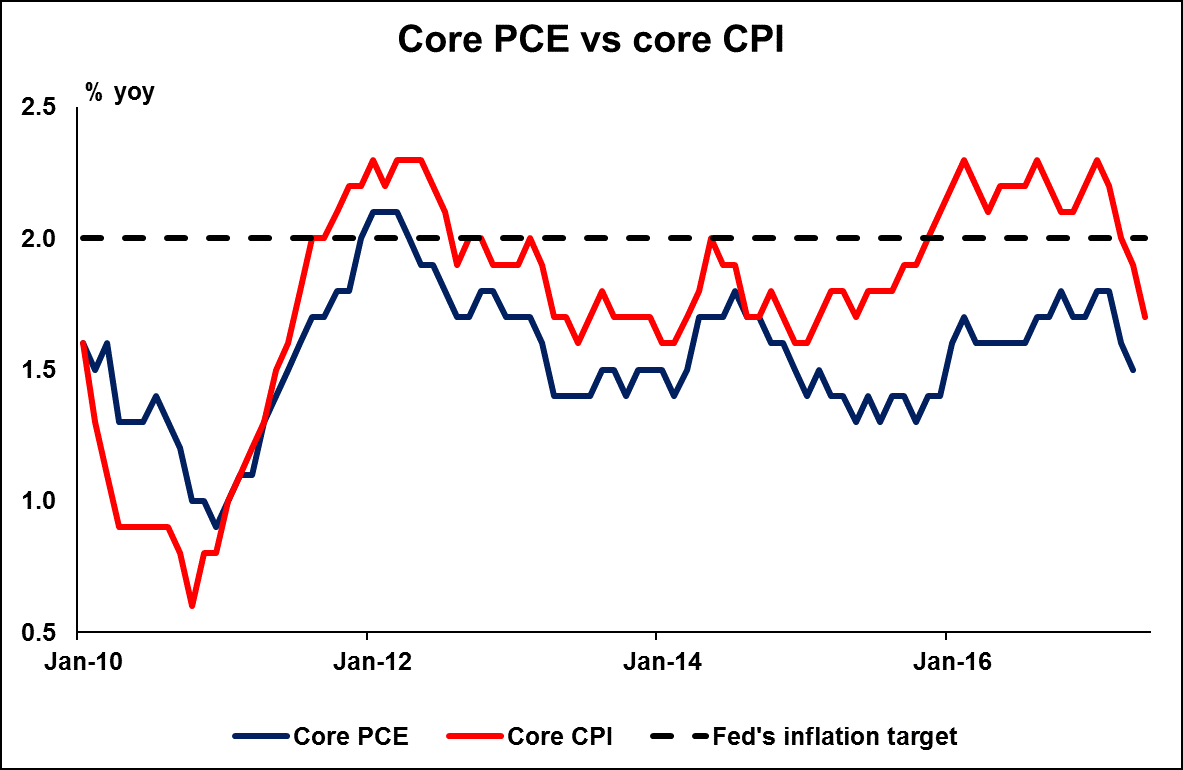

Staying in the US, we also get the core PCE index for May, but no forecast is available yet. Although prices charged by US service providers increased at a faster pace than previously according to the Markit services PMI for the month, we still see the risks surrounding the core PCE print as tilted to the downside. We base our view on the unexpected decline in the core CPI rate for the month.