- Intraday Comment

-

02.03.2015, 2pm

The dollar traded lower against most of its G10 counterparts during the European morning Monday. It was higher against CHF and NOK, in that order, while it was unchanged against JPY and CAD.

The euro traded higher even after Eurozone’s final manufacturing PMI for February declined a bit from the preliminary reading, but stayed above the 50 level. The German final manufacturing PMI increased a touch, adding to the recent encouraging data coming from the country. France’s final manufacturing PMI on the other hand, was revised marginally down from the preliminary figure and marked the 10th successive month in contraction. Eurozone estimate CPI fell 0.3% yoy in February, from -0.6% yoy in January, above expectations of -0.4% yoy. EUR/USD advanced at these developments and moved back above Thursday’s low of 1.1180. This could trigger further upside extensions, perhaps for another test near the 1.1260 resistance area.

The British pound remained elevated after the UK manufacturing PMI for February increased to 54.1 from 53.1 in January, beating market expectations. This showed that the manufacturing output growth picked up in the beginning of 2015, and kept GBP supported. Wednesday’s service-sector PMI is expected to support the fact that the economy is gaining momentum again and could push GBP/USD above the resistance of 1.5450.

AUD is likely to come under increased pressure due to concerns over the growth of its biggest trading partner, China, and ahead of the Reserve Bank of Australia policy meeting on Tuesday. The market consensus is for another 25 bps rate cut to 2%, driven mainly by the disappointing Q4 private capital expenditure. Another rate cut by the RBA is likely to weaken AUD further, in our view.

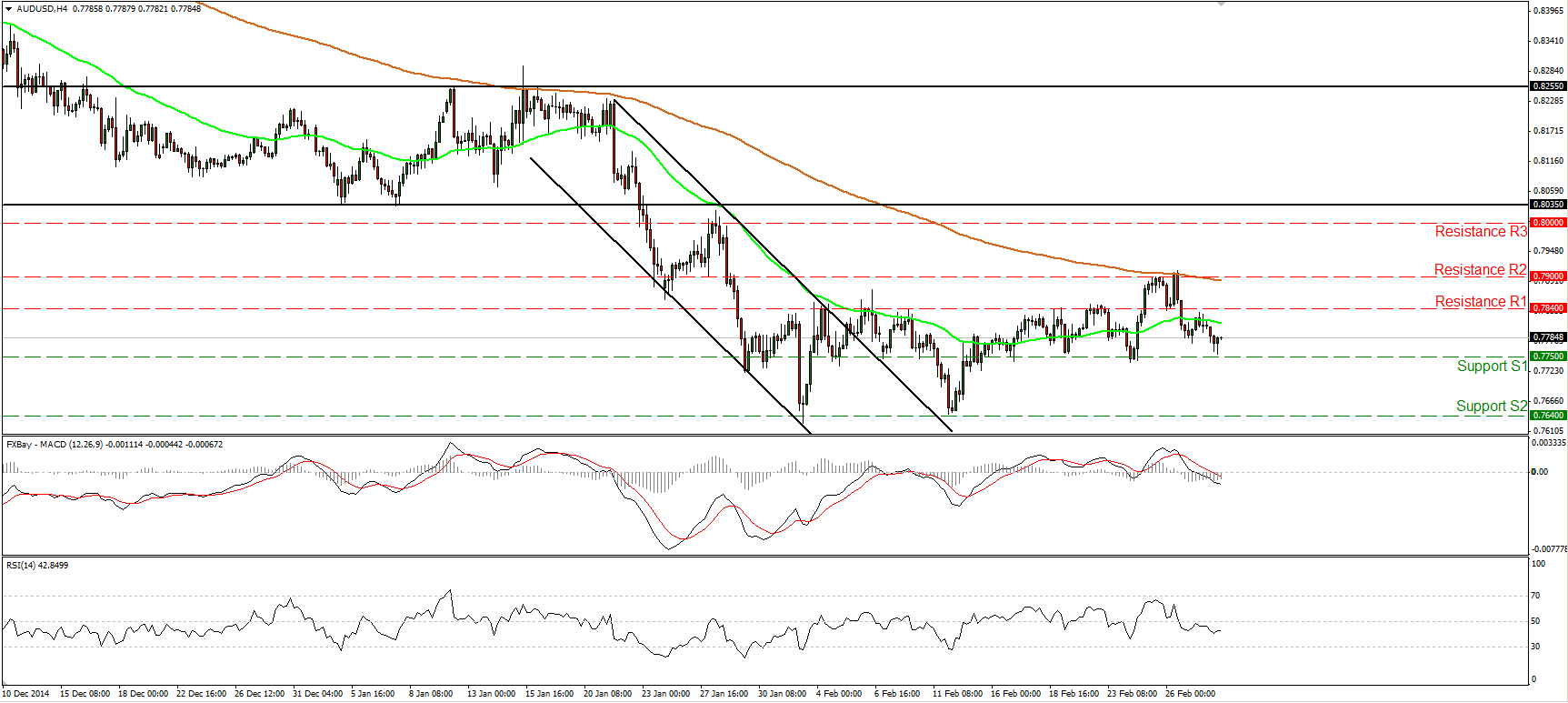

AUD/USD traded somewhat higher during the European morning Monday after hitting support fractionally above the 0.7750 (S1) support zone. However, having in mind that tomorrow the RBA is expected to cut its benchmark interest rate, I would expect the rebound to be short-lived and stay limited below the 0.7840 (R1) zone. Such a decision by the Bank could encourage the bears to drive the battle below the support hurdle of 0.7750 (S1), something that could pull the trigger for downside extensions towards the 0.7640 (S2) territory, defined by the lows of the 3rd and 12th of February. Switching to the daily chart, I see that the overall trend of the pair is still to the downside. Therefore, I would treat the recovery from 0.7640 (S2) as a corrective move. I still believe that we are going to see AUD/USD challenging the 0.7500 (S3) territory in the future.

• Support: 0.7750 (S1), 0.7640 (S2), 0.7500 (S3).

• Resistance: 0.7840 (R1), 0.7900 (R2), 0.8000 (R3).