Daily Commentary | 22/05/2017

ECB policymakers provide more “hawkish” hints

The euro strengthened yesterday, following some relatively “hawkish” remarks from ECB Executive Board members Sabine Lautenschlager and Jens Weidman. Lautenschlager indicated that although the current ultra-loose ECB policy is necessary for now, the Bank should be prepared to change its stance as soon as the data are stable and there is a sustainable path towards the ECB’s price stability objective. Weidman’s comments were along the same lines. He said that he would like to see a less expansionary policy, but there is no sustainable price growth yet to justify something like that. Today, we will get to hear from another ECB Executive Board member, Benoit Coeure, and it will be interesting to see whether his comments echo those of his colleagues. If so, the euro could come under renewed buying interest.

Even though yesterday’s comments are far from a clear signal that the ECB may actually change its policy anytime soon, they add to expectations that the era of ultra-loose monetary policy is approaching its final stages. They also place even more emphasis on the bloc’s preliminary CPI data for March that come out on Friday, especially on the core rate. According to President Draghi this is the data point the Bank pays the most attention to. The rate is expected to have remained unchanged for the fourth consecutive month, but a potential uptick in coming months could fuel further speculation over a potential reduction in ECB stimulus as early as next year.

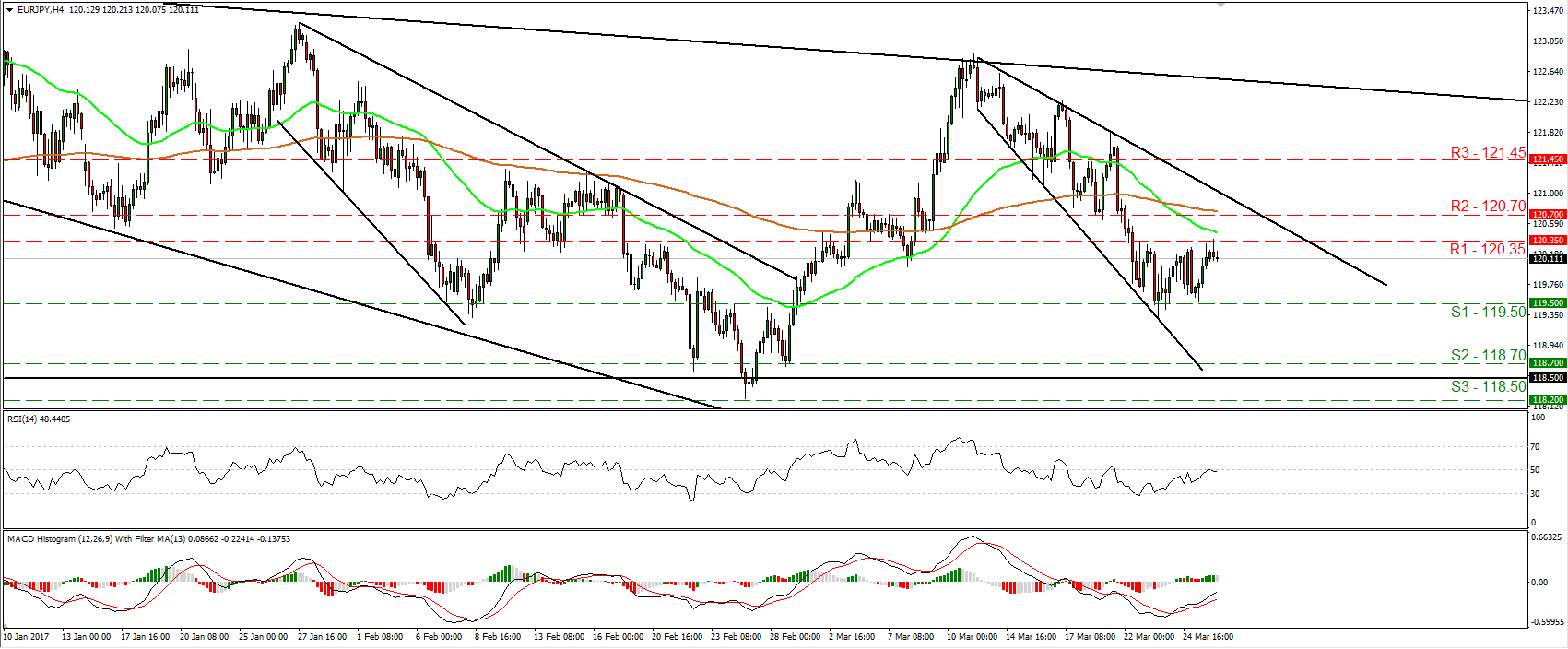

EUR/JPY traded higher on the aforementioned remarks, after it hit support once again near the 119.50 (S1) support territory. Nevertheless, the rebound was stopped by the 120.35 (R1) resistance. Even though the common currency outperformed most of its counterparts the last couple of weeks, it still underperformed the much stronger yen. This is evident by the price structure on the 4-hour chart where a near-term downtrend is in place since the 13th of March. Yes, we expect the euro to continue strengthening against other currencies, but we see the likelihood that it remains on the back foot against its Japanese peer, at least in the next few days. The bears may take advantage of the 120.35 (R1) resistance and perhaps pull the trigger for another test near 119.50 (S1).

Today’s highlights: During the European day, the economic calendar is relatively light. The only noteworthy indicators we get are Sweden retail sales and PPI, both for February.

In the US, the Conference Board consumer confidence index for March is due out. The forecast is for the figure to have declined, but to still remain at an elevated level. We also get the S&P/Case-Shiller house price index for January, as well as the Richmond Fed manufacturing index for March. However, none of these indicators is usually a major market mover.

Since we get only second-tier indicators today, market participants are likely to lock their gaze on the six speakers we have on the agenda. Besides ECB’s Coeure, we have speeches from Fed Chair Janet Yellen, Kansas City Fed President Esther George, Dallas Fed President Robert Kaplan, Bank of Canada Governor Stephen Poloz and Riksbank Governor Stefan Ingves. Although all of these speakers are important, we think that Yellen, Poloz, and Coeure are the three likely to steal the show.

With regards to Yellen, her comments will probably be scrutinized for any hints on when the Fed may raise rates next, and whether the summer FOMC meetings are appropriate candidates for such action. Having said that, we don’t expect any major deviation from her comments two weeks ago at the March FOMC meeting, where she maintained a somewhat cautious tone, and did not offer any clear signs regarding the next rate move. If she continues to keep her cards close to her chest, then the reaction in USD may be limited.

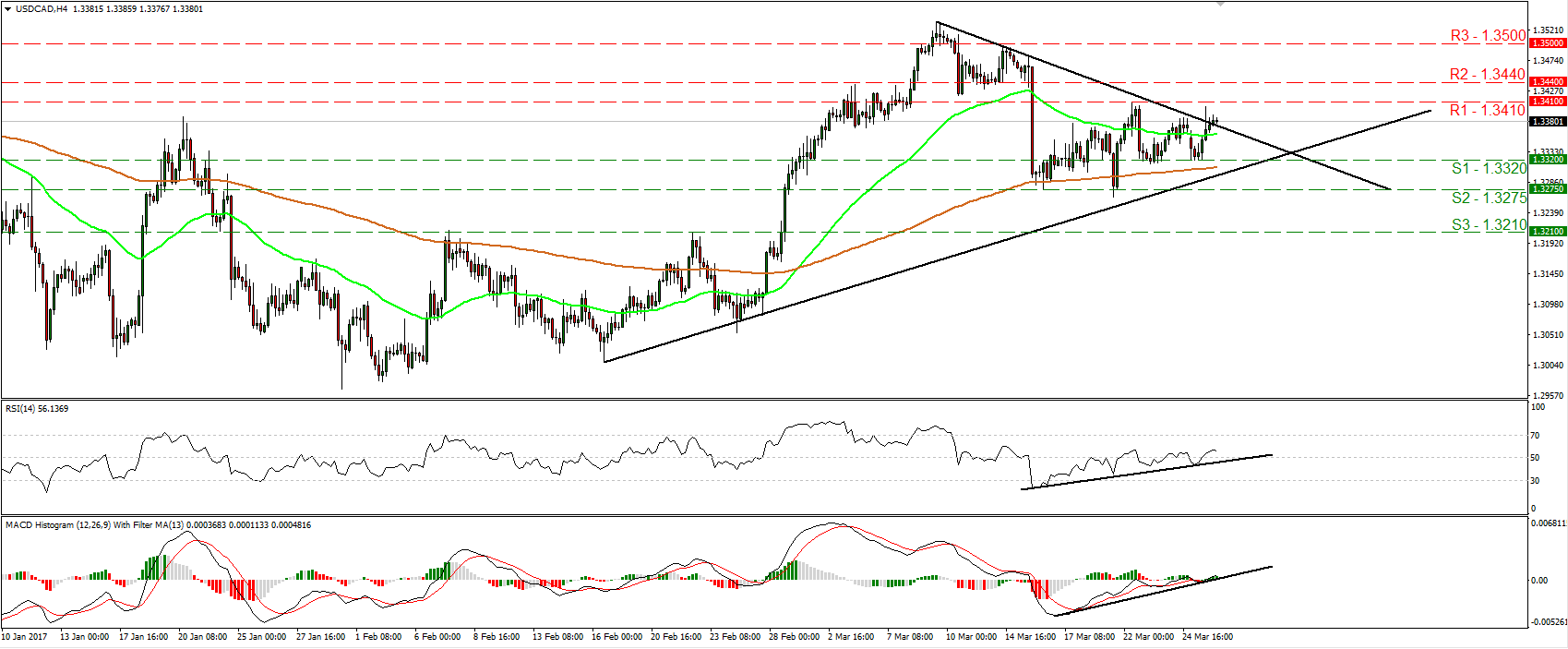

As for BoC Governor Poloz, we have to note that in his last few appearances he maintained a more-dovish-than-expected tone, indicating that another rate cut remains on the table should downside risks materialize in the Canadian economy. USD/CAD edged north yesterday after it hit support at 1.3320 (S1) to emerge above the downside resistance line taken from the peak of the 9th of March. In our view, the break shifts the near-term outlook back to the upside and as such, we expect a test near 1.3410 (R1) soon. A break above that zone is possible to pave the way for our next resistance of 1.3440 (R2). The catalyst for further advances in this pair could be another set of dovish remarks by Governor Poloz today.

EUR/JPY

• Support: 119.50 (S1), 118.70 (S2), 118.50 (S3)

• Resistance: 120.35 (R1), 120.70 (R2), 121.45 (R3)

USD/CAD

• Support: 1.3320 (S1), 1.3275 (S2), 1.3210 (S3)

• Resistance: 1.3410 (R1), 1.3440 (R2), 1.3500 (R3)